META Oracle Report - 2026-01-31

Oracle Commentary

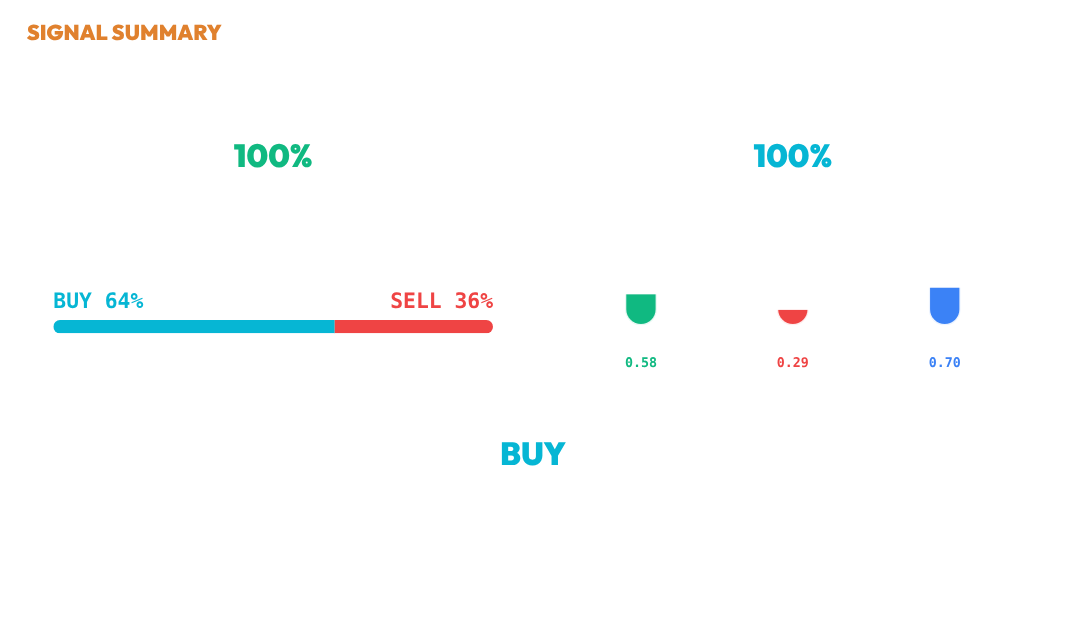

As of the latest analysis, the system maintains a 100.0% exposure following a BUY signal with full conviction at 100.0%, and the current price of META stands at $716.50 (Signal Panel, Position & Risk). Over the past three months, META has experienced a volatile price environment with notable fluctuations and a recent rebound starting in early January 2026 (Chart Analysis). Monte Carlo simulations indicate a strong buy probability of 75.0% against a sell probability of 25.0%, with a high bias confidence of 100.0% and ensemble stability reflected by an entropy of 0.81 (MC Bias). Despite the structurally stressed market environment noted in the Decision Audit, which highlights moderate material integrity at 58.1% and weak energetic integrity at 28.9%, the system's factors align to confirm a BUY consensus with a stable regime and a conviction margin of 0.015 (Decision Audit). Taken together, the system's posture reflects a strategic commitment to the BUY signal, supported by high probabilistic coherence and a robust conviction level across analytical domains.

Signal Summary

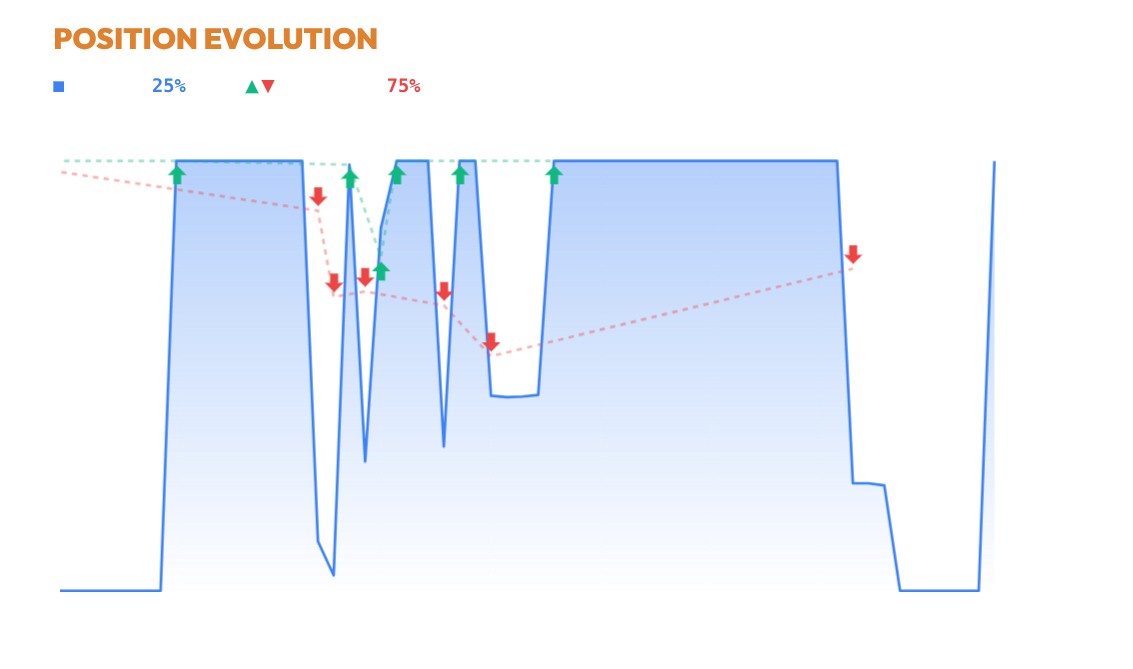

POSITION

Exposure stands at 25.1% following a sell action on January 14, 2026, which reduced allocation from 100% to 25.1%. The blue exposure line shows a sharp decline, indicating a rapid reduction in allocation. The system is currently maintaining a low exposure level.

CHART

The chart for META over the past three months showcases a volatile price environment, with significant fluctuations and a notable rebound starting in early January 2026. Throughout this period, the system frequently alternated between BUY and SELL decisions, reflecting the price volatility. Confidence in decisions varied, with stronger conviction noted during BUY actions, especially in early December where confidence reached 100%. The current allocation reveals a cautious stance, with 74.9% held in cash, following a recent SELL decision on January 14, 2026. This consistent pattern of re-evaluation and reallocation suggests a strategic effort to navigate the unpredictable market conditions. The chart reflects a period of strategic cash retention as price volatility remains high.

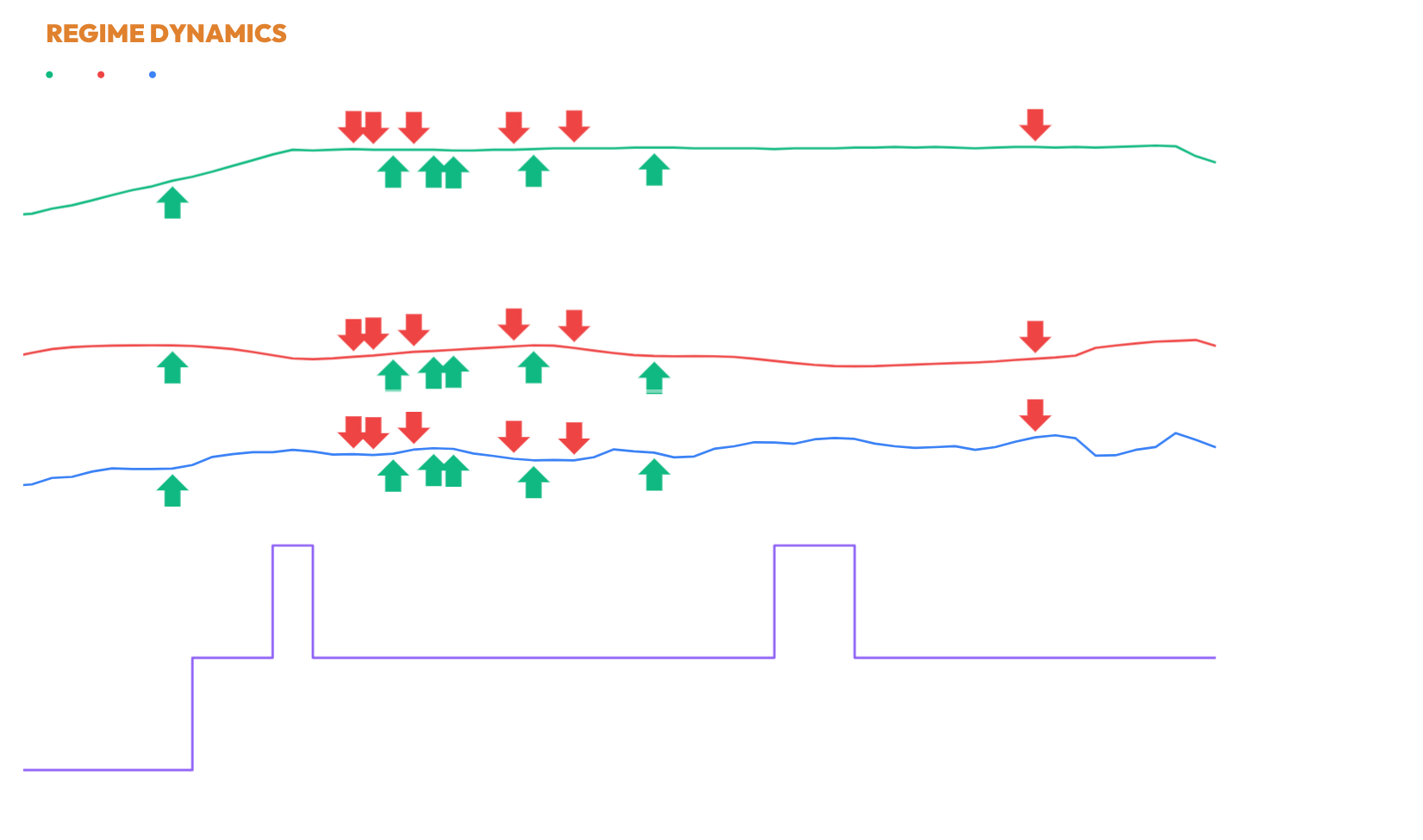

REGIME

Material Integrity stands at 58.1%, indicating moderate structural health with a slight negative trend, while Energetic Integrity is weak at 28.9%, also trending downward. Ethereal Integrity is relatively strong at 70.5% but shows a minor decline. Within the CHOP regime, this combination suggests a structurally stressed environment with elevated noise and reduced directional clarity. The provided trade history does not allow a clear temporal linkage between execution and integrity changes. Overall, the market environment appears unstable with limited directional predictability.

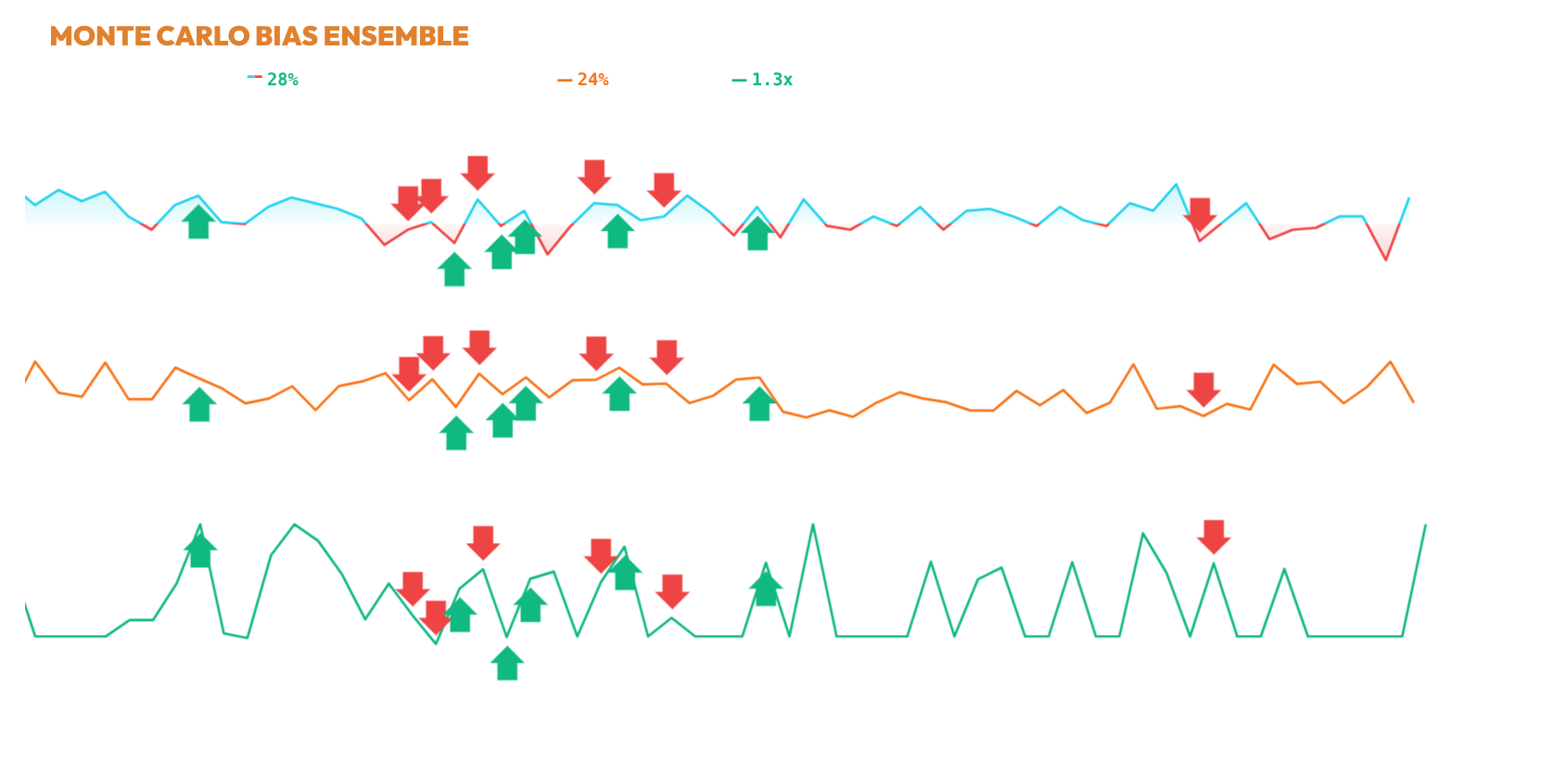

MCBIAS

As of the timestamp 2026-01-29T19:00:00, the SagaHalla Stochastic Ensemble model simulates a 60-bar forward horizon, showing a raw directional probability of 75.0% for p_buy and 25.0% for p_sell. This indicates a strong positive directional drift. The distribution spread, with an ensemble_entropy of 0.81, suggests a high concentration and coherence among simulated paths. After applying dispersion penalties, the bias confidence remains robust at 100.0%, resulting in a maximum MC sizing multiplier of 1.30x. Although the pure MC bias aligns with a buy direction, it is noted that the final ensemble decision is also a buy, reinforcing the agreement across the system's factors. Probabilistic simulations show a consistent positive bias, reinforcing the decision to maintain current exposure level.

DECISION

📊 Ensemble Consensus: BUY

[BuyStats] z=3.87, Sharpe=3.42, Hurst=0.60, ADX=25.8, AC=0.04 (x2)

[BuyCalc] base=0.412, integ=0.70→1.15, vov=0.01→1.12 → conf=0.532 (x2)

[Filter] Min Ethereal Integrity=0.453, Max Volatility Stability=0.062, Ethereal Integrity=0.705, Volatility Stability=0.006 (x2)

[decision] 📏 Conviction margin=0.015 (integrity=0.70, integ_trend=-0.000, trend_dir=+1); 🟢 Stable regime (0.70); ⚖️ Conviction Δ=0.134 → dominance=1.00; ✅ Confirmed BUY (MC=1.00) (x1)

✅ Action: BUY (conf=0.68) (x1)

transparency note: this report is generated by individual decision engines (price, regime, momentum, probability) and synthesized by a consensus logic layer. the 'verdict' is the raw output of that consensus. full methodology and live trace available in the execution logs.

Member discussion