QQQ Oracle Report - 2026-01-30

Oracle Commentary

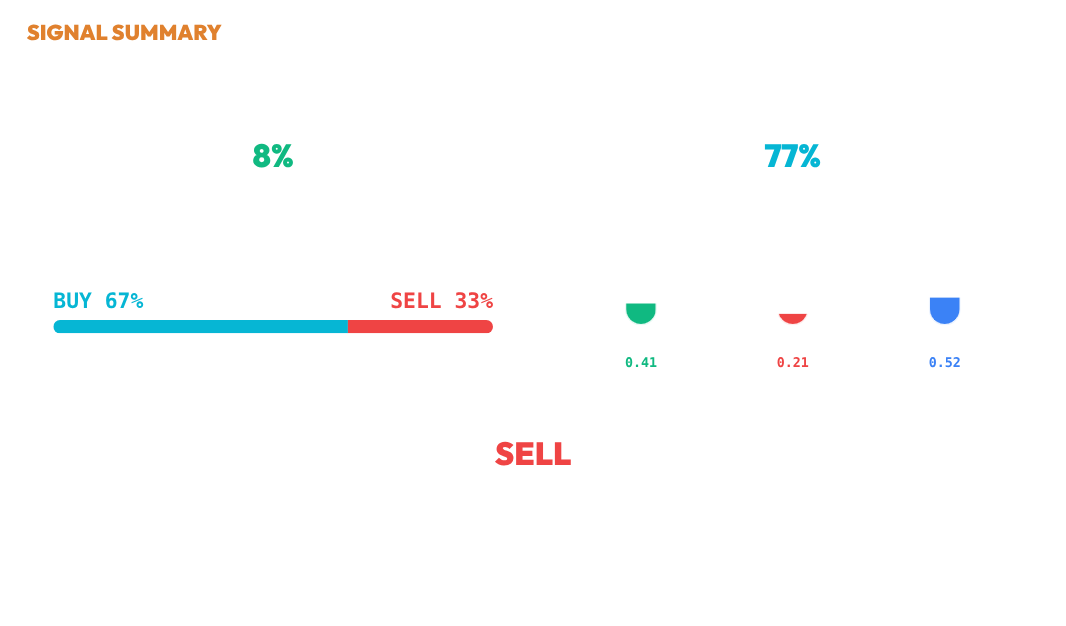

As of January 27, 2026, the system maintains an 8.0% exposure following a SELL signal with a conviction of 76.8%, at a current price of $633.22 (Signal Panel, Position Metrics). The chart analysis from late October 2025 to late January 2026 reflects significant volatility with alternating bullish and bearish phases, culminating in a strong upward movement, but overall maintaining a cautious stance with a substantial cash position of 92.0% (Chart Analysis, Position Metrics). Monte Carlo simulations indicate a probability of 67.0% for a positive outcome (p_buy) and 33.0% for a negative outcome (p_sell), suggesting a positive bias despite the SELL recommendation due to overriding regime factors (MC Projections). The Decision Audit reveals weak material integrity at 40.9% and low energetic integrity at 21.5%, reflecting structural stress and declining volatility, supporting the SELL action (Decision Audit). Taken together, the system's posture reflects a strategic decision to prioritize liquidity and capital preservation amidst market noise and limited directional clarity.

Signal Summary

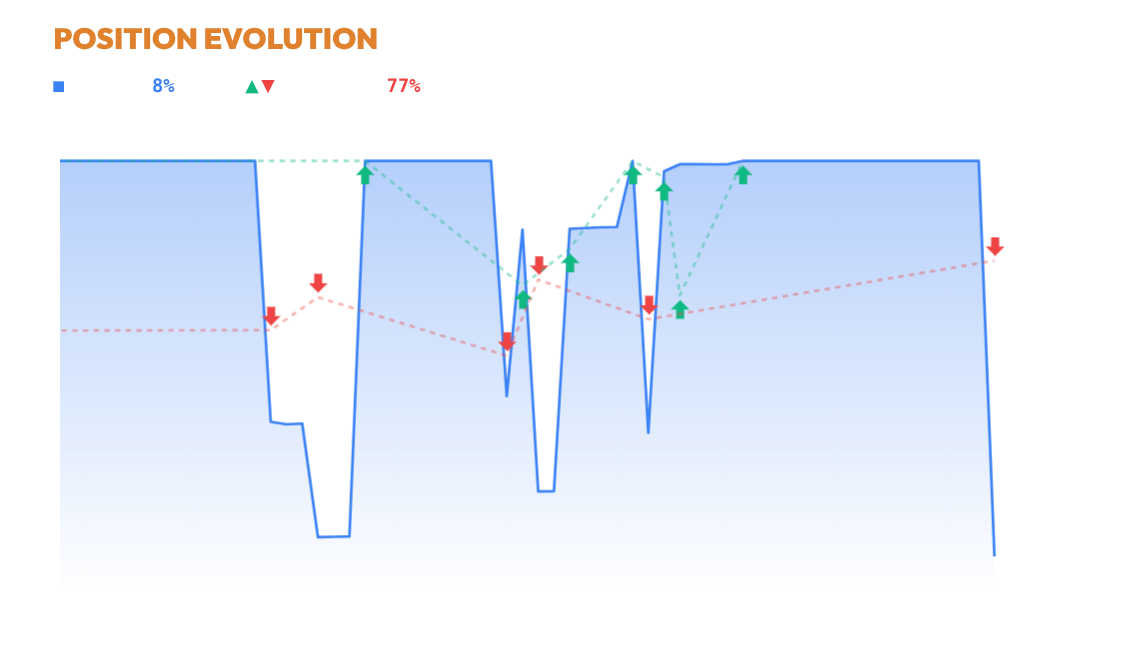

POSITION

Exposure stands at 8.03% following the sell action on January 27, which reduced allocation from 100% to 8%. The BLUE EXPOSURE line shows a sharp decrease pattern at the end. The system is currently in a significantly reduced exposure state.

CHART

The chart for QQQ from late October 2025 to late January 2026 shows a period of significant volatility with alternating bullish and bearish phases. Initially, the price experienced a decline, followed by a series of recoveries and dips, culminating in a strong upward movement towards the end of the period. Despite these fluctuations, the system maintained a cautious stance, as reflected in its HOLD decision and a substantial cash position of 65.3%. This suggests a low confidence in making aggressive allocations amidst the volatile price action. The chart's behavior indicates a period where maintaining liquidity was prioritized over taking on market exposure. The chart reflects a strategic decision to preserve capital in a turbulent market environment.

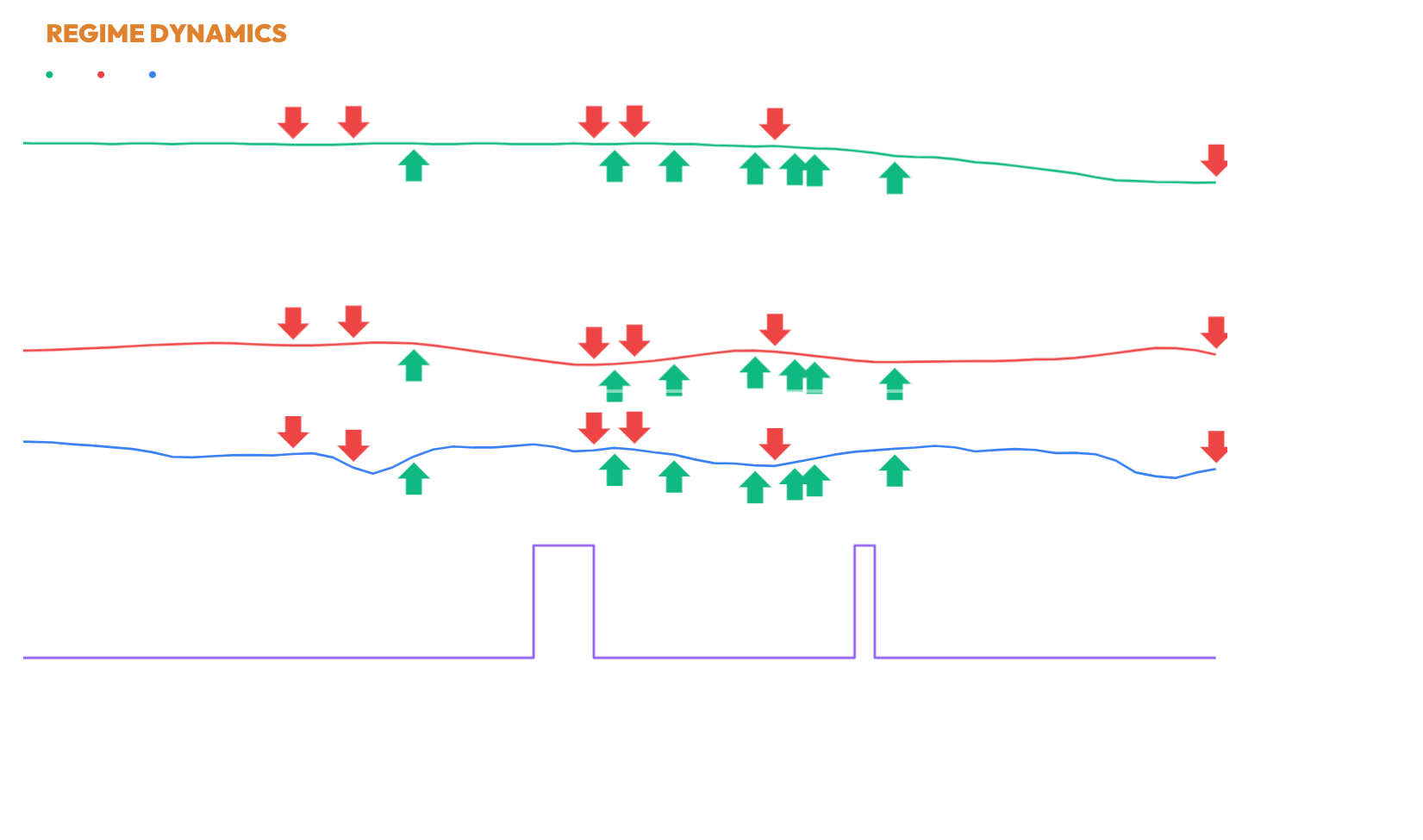

REGIME

Material integrity is weak at 40.9% with no recent trend change, indicating structural stress in price and volume. Energetic integrity is very low at 21.5%, showing declining volatility and participation. Ethereal integrity is moderately stable at 51.9%, with a slight upward trend in momentum persistence. Within the CHOP regime mode, these conditions reflect elevated noise and reduced coherence. The provided trade history does not allow a clear temporal linkage between execution and integrity changes. Overall, the market environment is noisy with limited directional clarity.

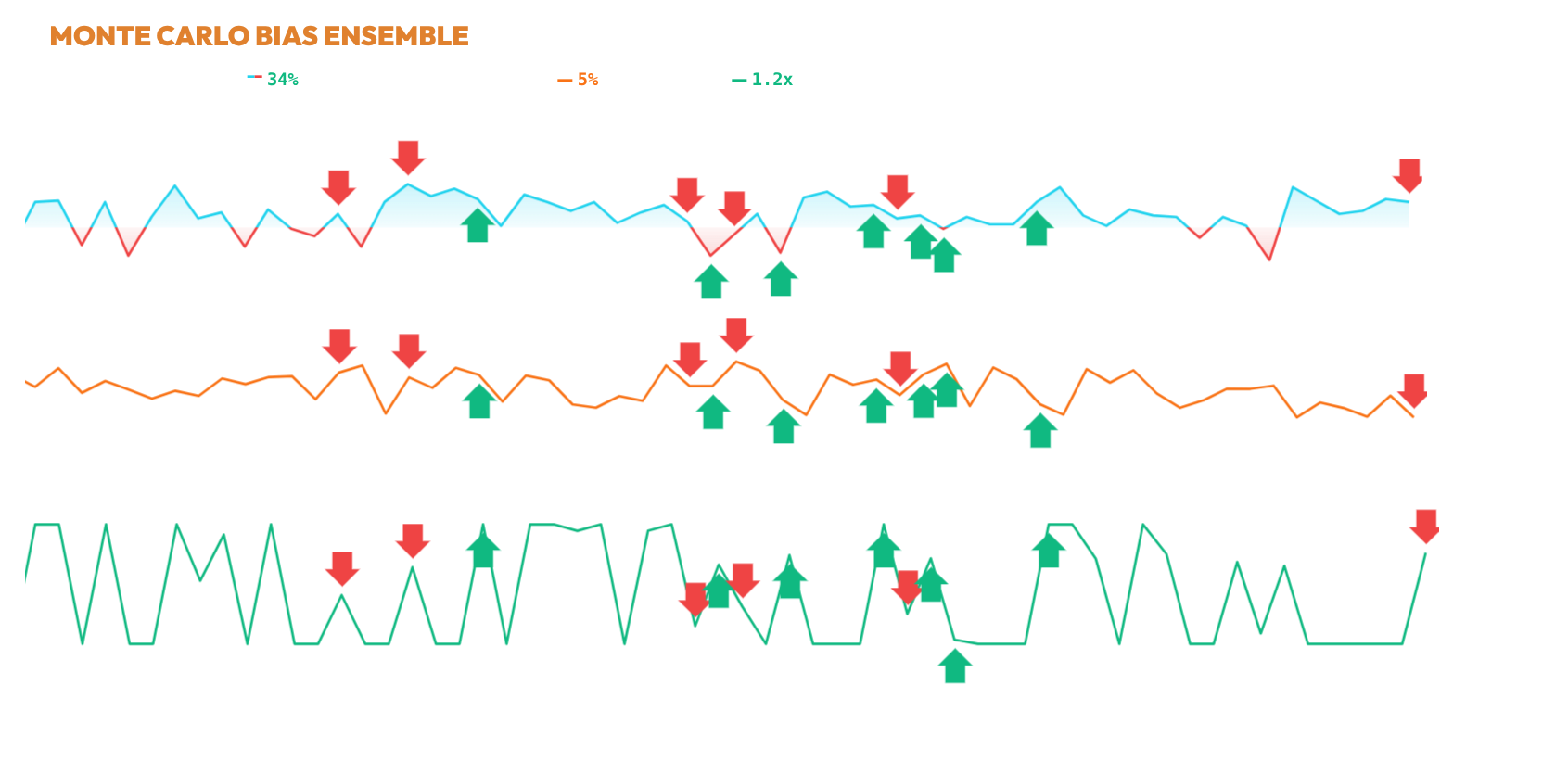

MCBIAS

On January 27, 2026, the SagaHalla Stochastic Ensemble model ran a Monte Carlo simulation over a 60-bar horizon, indicating a raw directional probability of 67% for a positive outcome (p_buy) and 33% for a negative outcome (p_sell). The distribution spread, characterized by an ensemble_entropy of 0.91, suggests high concentration and coherence among the simulated paths. With a bias confidence of 100% and an MC sizing multiplier of 1.23x, the scenario favors increased position sizing based on the Monte Carlo bias. Despite this, the final ensemble decision diverges, opting for a sell action due to overriding factors such as regime and integrities. Probabilistic simulations show a consistent positive bias, reinforcing the decision to maintain current exposure level.

DECISION

📊 Ensemble Consensus: SELL

[decision] ⚖️ Conflict → SELL prioritized (Δb=0.05, Δs=0.12, Δ=-0.08<-0.01) (x1)

[SellStats] z=0.94, Sharpe=0.70, Hurst=0.42, ADX=10.3, AC=-0.00 (x1)

[SellCalc] base=0.343, integ=0.52→0.97, vov=0.00→0.87 → conf=0.290 (x1)

[Filter] Min Ethereal Integrity=0.451, Max Volatility Stability=0.053, Ethereal Integrity=0.519, Volatility Stability=0.001 (x1)

[Ethereal Integrity] level=0.52, trend=+0.000 → ×1.00 (x1)

Cycle resistance adaptive: base=0.91, damp=0.82, regime=0.47 (x1)

[Scenario cycle_resistance_sell] score=0.77 → +16.0% (x1)

✅ Action: SELL (conf=0.55) (x1)

transparency note: this report is generated by individual decision engines (price, regime, momentum, probability) and synthesized by a consensus logic layer. the 'verdict' is the raw output of that consensus. full methodology and live trace available in the execution logs.

Member discussion