QQQ Oracle Report - 2026-01-30

Oracle Commentary

As of January 28, 2026, the system maintains a 94.1% exposure following a BUY signal with a 69.5% conviction level, at a current price of $629.43 (Signal Panel, Position Metrics). The QQQ chart over the past three months indicates a volatile yet upward price momentum, with strategic accumulation during dips (Chart Analysis). Monte Carlo projections show a balanced probability with both p(buy) and p(sell) at 50.0%, but other system factors have resulted in a buy decision despite this neutrality (MC Bias). The Decision Audit reveals a market environment marked by inconsistency and a lack of clear direction, yet consensus aligns with the BUY action due to the overriding system dynamics (Decision Audit). Taken together, the system's current posture reflects an aggressive stance aimed at capitalizing on potential gains from the recent price recovery, despite the neutral probabilistic outlook and mixed integrity signals.

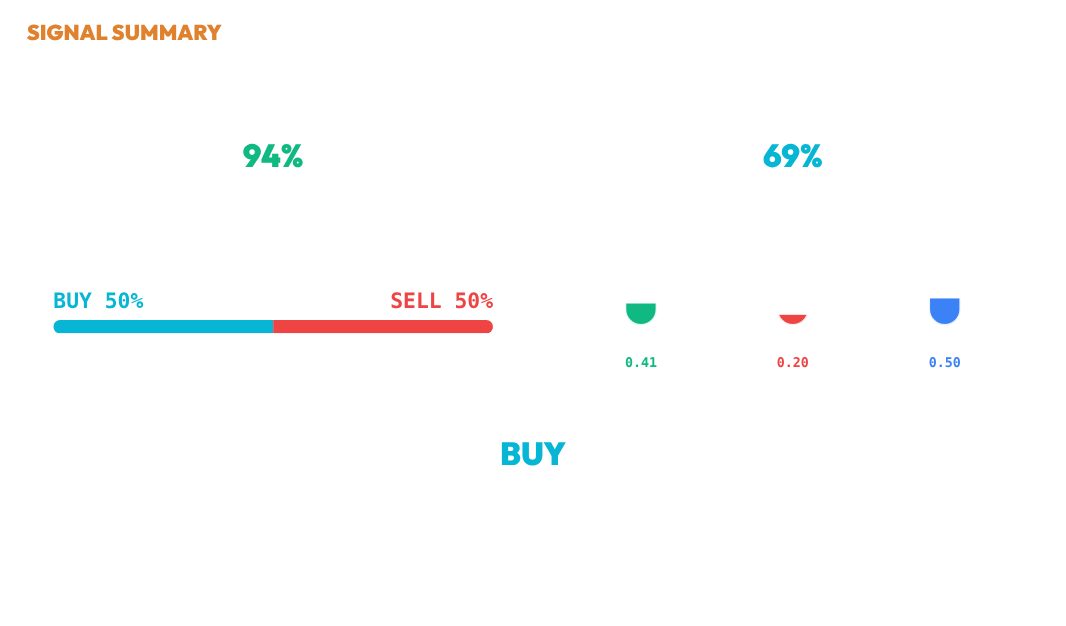

Signal Summary

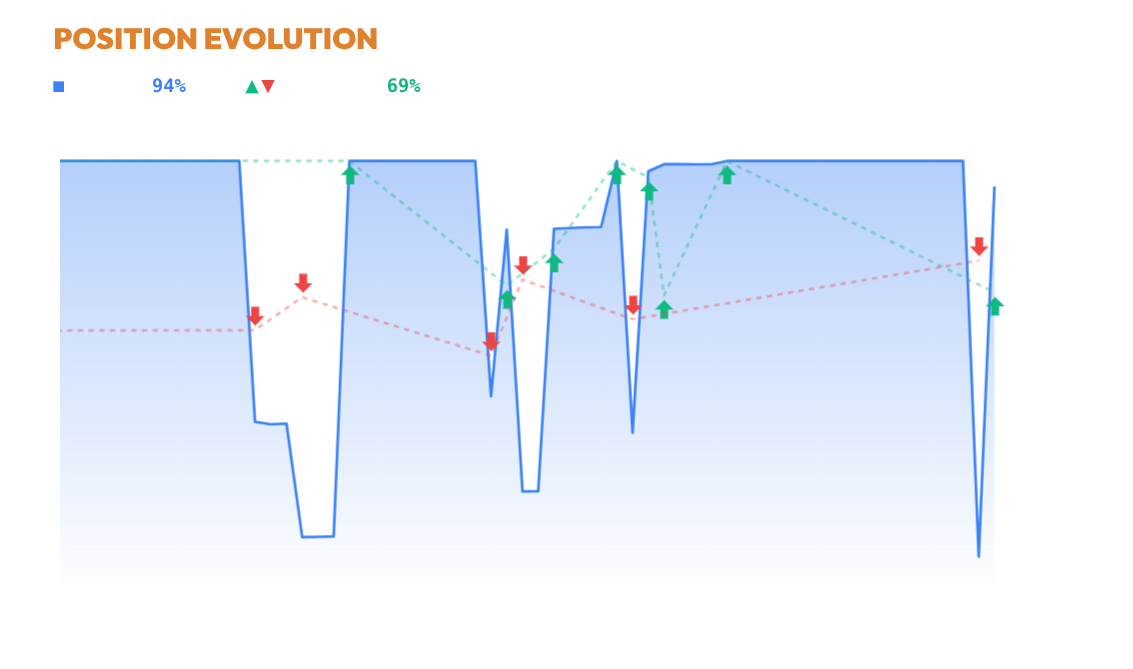

POSITION

Exposure stands at 94.1% as of January 28, following a significant increase from 8.0% due to a buy action. On January 27, the system had decreased exposure sharply from 100.0% to 8.0%. The blue exposure line shows a rapid spike upwards after a steep decline. The system is nearly fully invested after a rapid re-entry into the market.

CHART

Over the past three months, the QQQ chart indicates a volatile yet upward price momentum, with several fluctuations leading to alternating buy and sell decisions. The system showed a strong inclination to buy during dips, as seen with multiple buy actions during December and early January, which corresponded with temporary price declines. The confidence levels varied, with some buy actions reaching full conviction, particularly on December 22 and January 4, suggesting high certainty in those upward moves. The allocation has shifted to a significant position size of 94.1%, reflecting an aggressive stance towards capturing potential gains from the recent price recovery. The latest buy decision on January 28, paired with a moderate confidence level, indicates a continued positive outlook despite recent volatility. The chart reflects a period of strategic accumulation as the price trends towards higher levels.

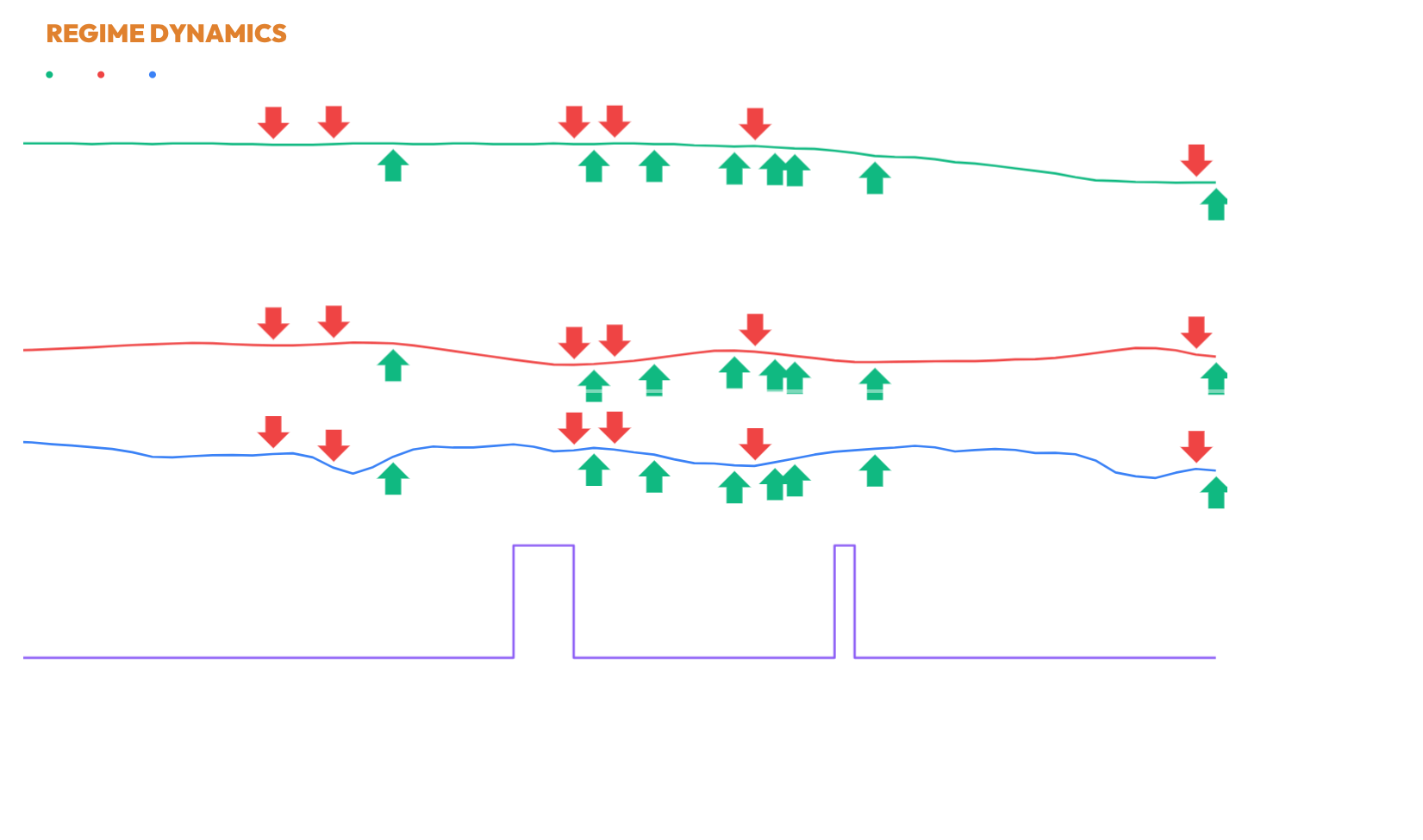

REGIME

Material integrity is weak at 40.9%, showing no recent trend change, indicating a lack of structural coherence. Energetic integrity is very poor at 19.7%, with a slight declining trend, reflecting low volatility and participation stability. Ethereal integrity stands at 50.4%, showing moderate structural health with minor degradation. Within the CHOP regime mode, these conditions highlight elevated noise and reduced directional coherence. The provided trade history does not allow a clear temporal linkage between execution and integrity changes. Overall, the market environment is marked by inconsistency and lack of clear direction.

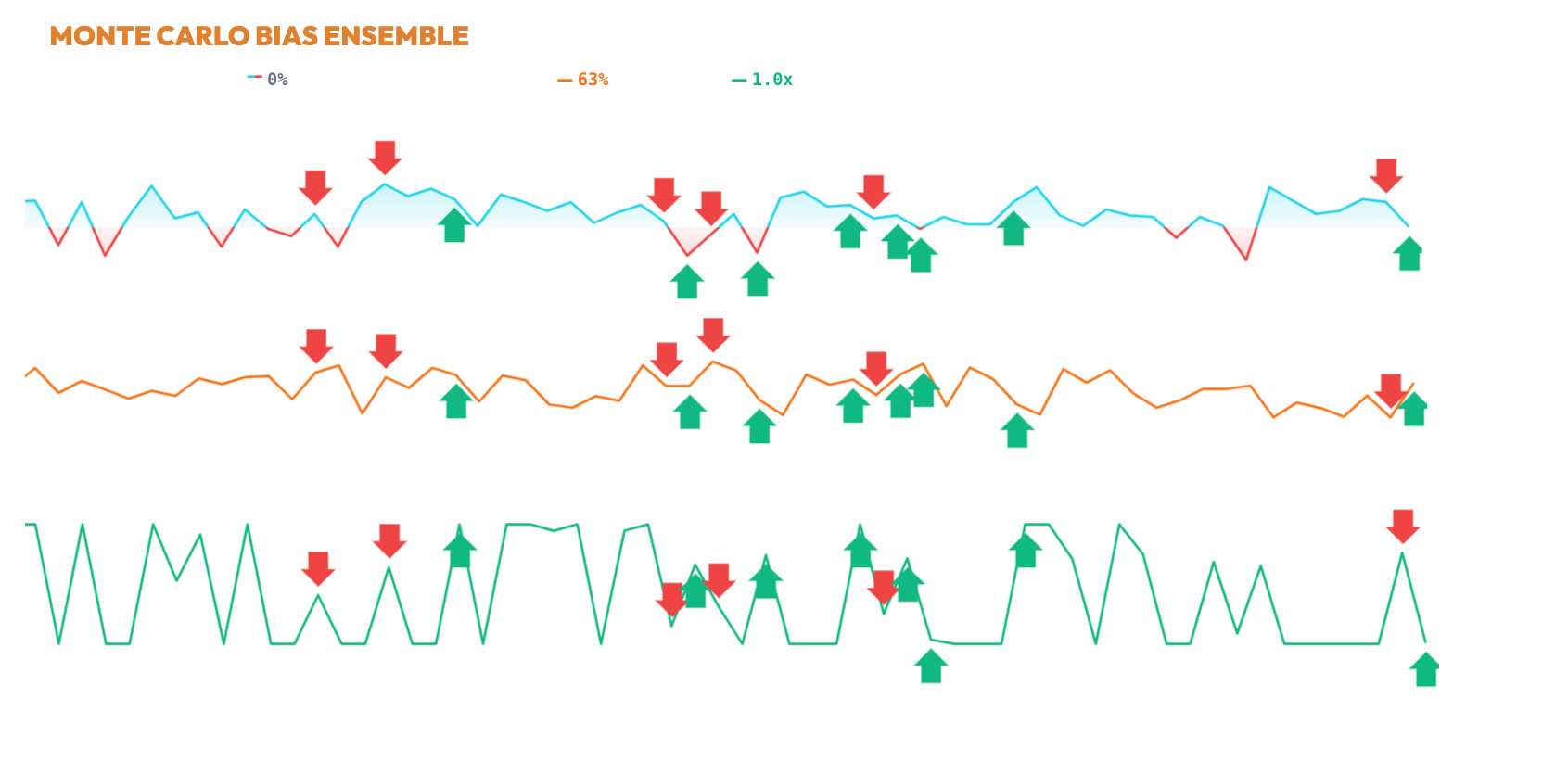

MCBIAS

As of the timestamp 2026-01-28T19:00:00, the SagaHalla Stochastic Ensemble model projects a balanced directional probability with p_buy and p_sell both at 50.0%, indicating no raw directional drift. The distribution spread is highly concentrated, as shown by an ensemble_entropy of 1.00, suggesting strong coherence among simulated paths. However, bias confidence is at 0.0%, reflecting that risk adjustments have nullified any derived directional bias, maintaining a neutral MC sizing multiplier of 1.00x. Despite this neutrality, the final ensemble decision is a buy, indicating that other system factors such as regime and integrities have overridden the pure MC signal. Probabilistic simulations show no inherent bias, suggesting a neutral stance in the absence of additional system inputs.

DECISION

📊 Ensemble Consensus: BUY

[decision] ⚖️ Conflict → BUY prioritized (Δb=0.14, Δs=0.02, Δ=0.12>0.01) (x1)

[BuyStats] z=0.26, Sharpe=2.45, Hurst=0.37, ADX=10.2, AC=-0.05 (x1)

[BuyCalc] base=0.471, integ=0.50→1.01, vov=0.00→1.11 → conf=0.526 (x1)

[Filter] Min Ethereal Integrity=0.451, Max Volatility Stability=0.053, Ethereal Integrity=0.504, Volatility Stability=0.001 (x1)

✅ Action: BUY (conf=0.59) (x1)

transparency note: this report is generated by individual decision engines (price, regime, momentum, probability) and synthesized by a consensus logic layer. the 'verdict' is the raw output of that consensus. full methodology and live trace available in the execution logs.

Member discussion