BTC Oracle Report - 2026-01-05

Oracle Commentary

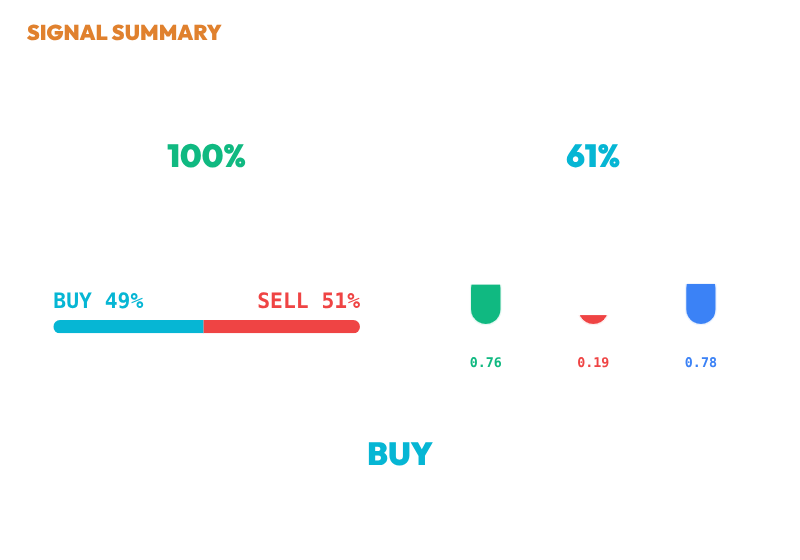

As of January 4 2026, the system maintains a full 100% exposure following a BUY signal with a conviction of 60.7% at a current price of $93,870.06 (Signal Panel). The chart analysis indicates a period of downward price trends initially, followed by consolidation and eventual stabilization, leading to a strong buying activity and full exposure by early January, reflecting bullish sentiment (Chart Analysis). Monte Carlo simulations report a neutral bias with p(buy) and p(sell) both at 0.0%, and an ensemble entropy of 1.00, suggesting perfect path agreement but no clear directional bias, warranting no adjustment to the current position size (MC Bias). The Decision Audit confirms alignment with the BUY signal, supported by a consensus and a conflict resolution favoring the BUY with a decision branch prioritizing this action (Decision Audit). Taken together, the current system posture reflects a full commitment to the bullish stance, despite the probabilistic neutrality, aligning exposure with strategic confidence and chart indications.

Signal Summary

CHART

The chart from October 2025 to January 2026 reveals a downward trend in BTC prices during the initial phase, followed by a period of consolidation. The system responded with a series of BUY decisions as the price stabilized, indicating increased confidence in a potential recovery. During December, confidence levels in buy signals were notably high, reaching up to 97.8%, reflecting a strong conviction in upward movement. The allocation shifted from mixed signals to a full 100% position size by early January, demonstrating a decisive shift toward bullish sentiment. The chart reflects a period of consistent accumulation as the price found stability and potential upward momentum.

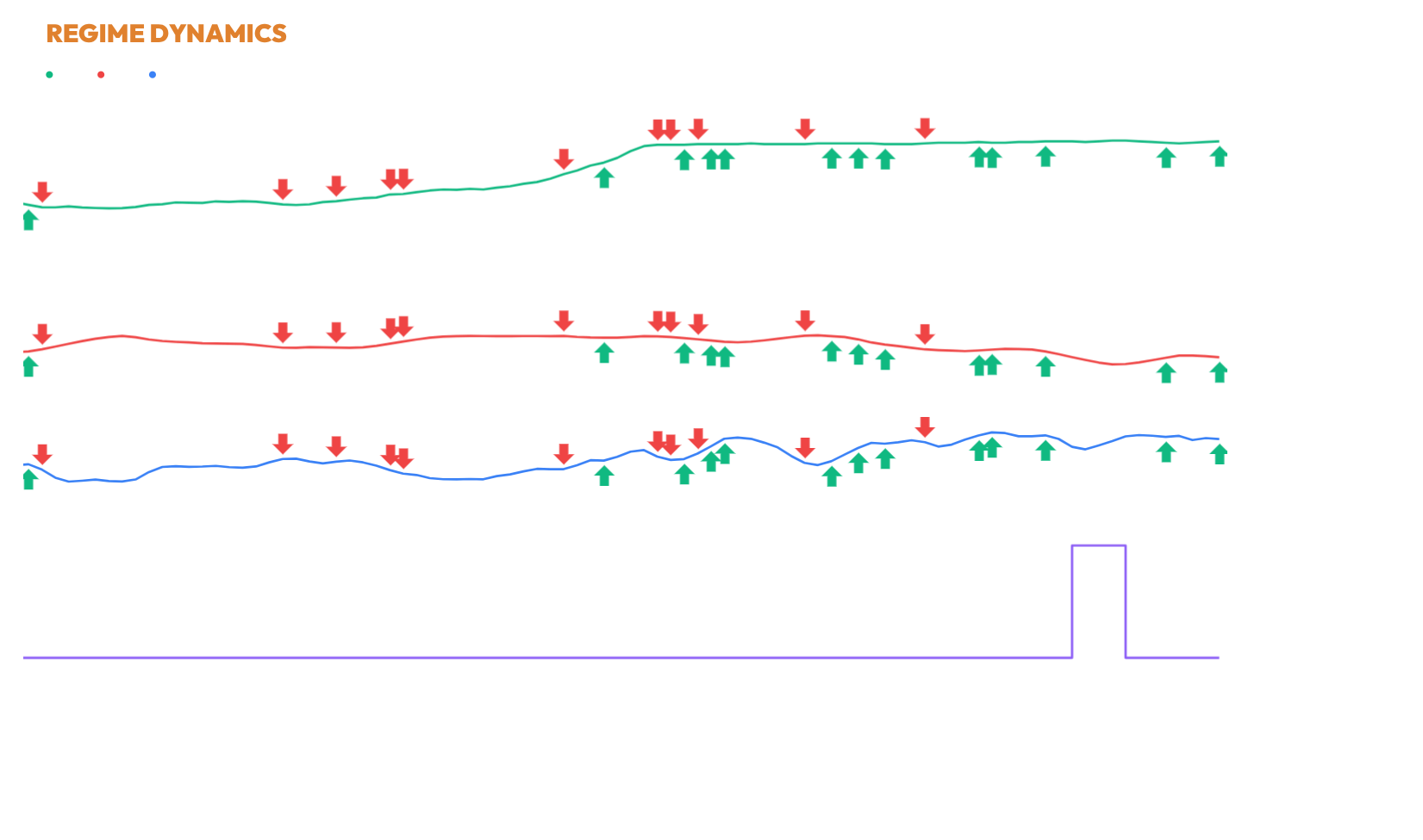

REGIME

Material Integrity shows moderate strength at 76.3%, with a slight upward trend, indicating some structural coherence in price and volume. Energetic Integrity is weak at 19.2%, reflecting significant volatility and participation instability. Ethereal Integrity is moderately strong at 77.6%, though experiencing a slight decline, indicating persistent momentum. Within the CHOP regime, characterized by elevated noise and reduced directional coherence, these dimensions reveal a mixed structural environment. The provided trade history does not allow a clear temporal linkage between execution and integrity changes. Overall, the market environment appears unstable with mixed structural signals.

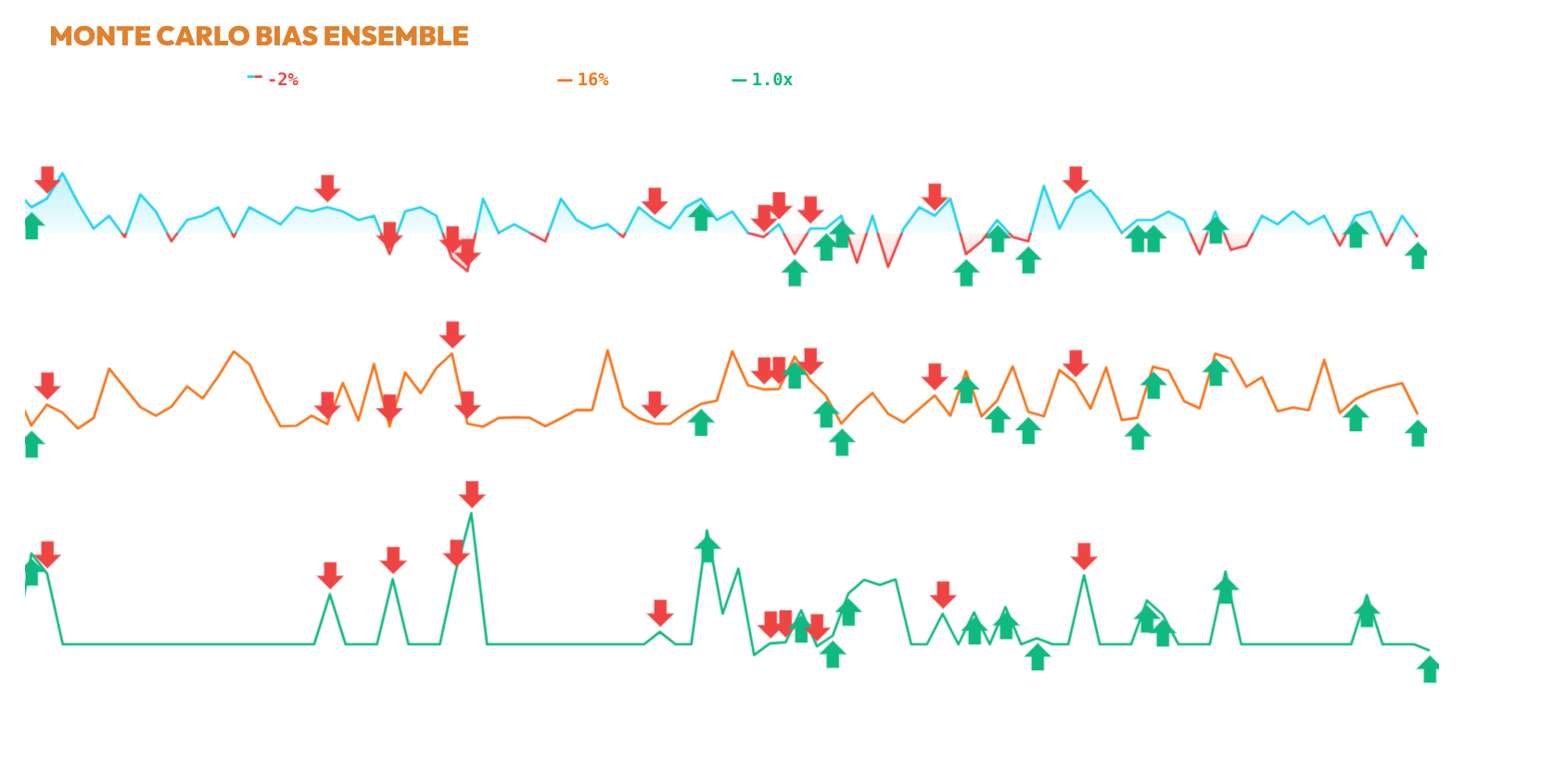

MCBIAS

The simulation conducted on January 4, 2026, using the SagaHalla Stochastic Ensemble model over a 60-bar horizon reveals no directional drift, as both p_buy and p_sell are at 0.0%. The distribution of simulated paths shows complete concentration with an ensemble_entropy value of 1.00, indicating perfect agreement among paths, albeit with no directional bias. Consequently, the bias confidence remains at 0.0%, reflecting the absence of a clear probabilistic direction after considering dispersion penalties. The MC sizing multiplier is neutral at 1.00x, suggesting no adjustment to position sizing is warranted based on the current bias confidence. With no change in exposure, and the final ensemble decision not specified, there is no divergence to note between MC bias and the system's action. Probabilistic simulations show a neutral bias, reinforcing the decision to maintain the current exposure level.

DECISION

📊 Ensemble Consensus: BUY

[decision] ⚖️ Conflict → BUY prioritized (Δb=0.09, Δs=0.04, Δ=0.05>0.01) (x1)

[BuyStats] z=0.62, Sharpe=1.03, Hurst=0.78, ADX=18.2, AC=-0.23 (x1)

[BuyCalc] base=0.409, integ=0.78→1.15, vov=0.00→1.13 → conf=0.532 (x1)

[Filter] Min Ethereal Integrity=0.451, Max Volatility Stability=0.065, Ethereal Integrity=0.776, Volatility Stability=0.001 (x1)

✅ Action: BUY (conf=0.69) (x1)

🧗 Tier Snap: 0.76 (conf=0.69 >= 0.65) | 🛡️ Structural Adj: 0.80x

transparency note: this report is generated by individual decision engines (price, regime, momentum, probability) and synthesized by a consensus logic layer. the 'verdict' is the raw output of that consensus. full methodology and live trace available in the execution logs.

Member discussion