ETH Decision Analysis - January 4, 2026

Oracle Commentary

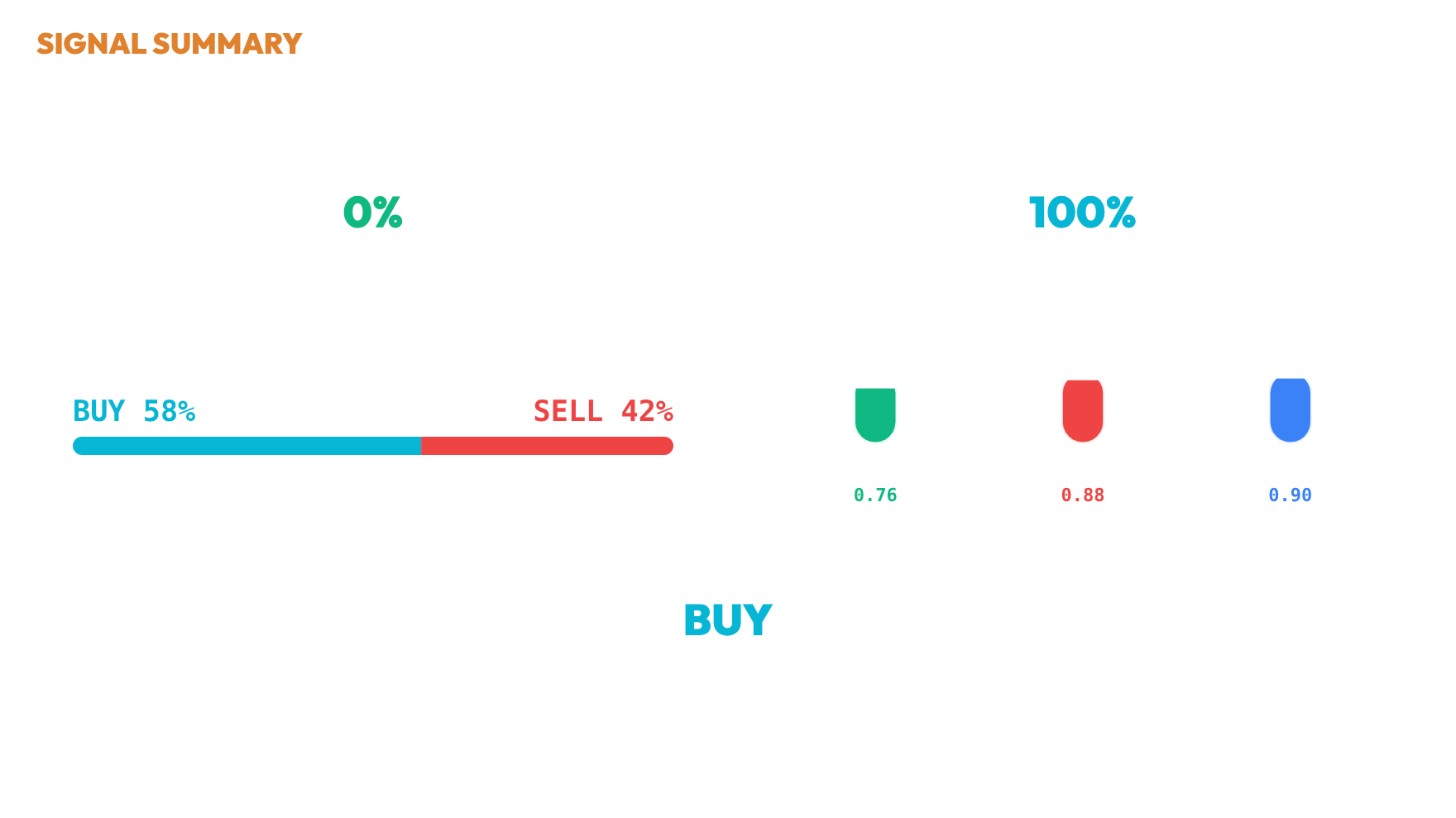

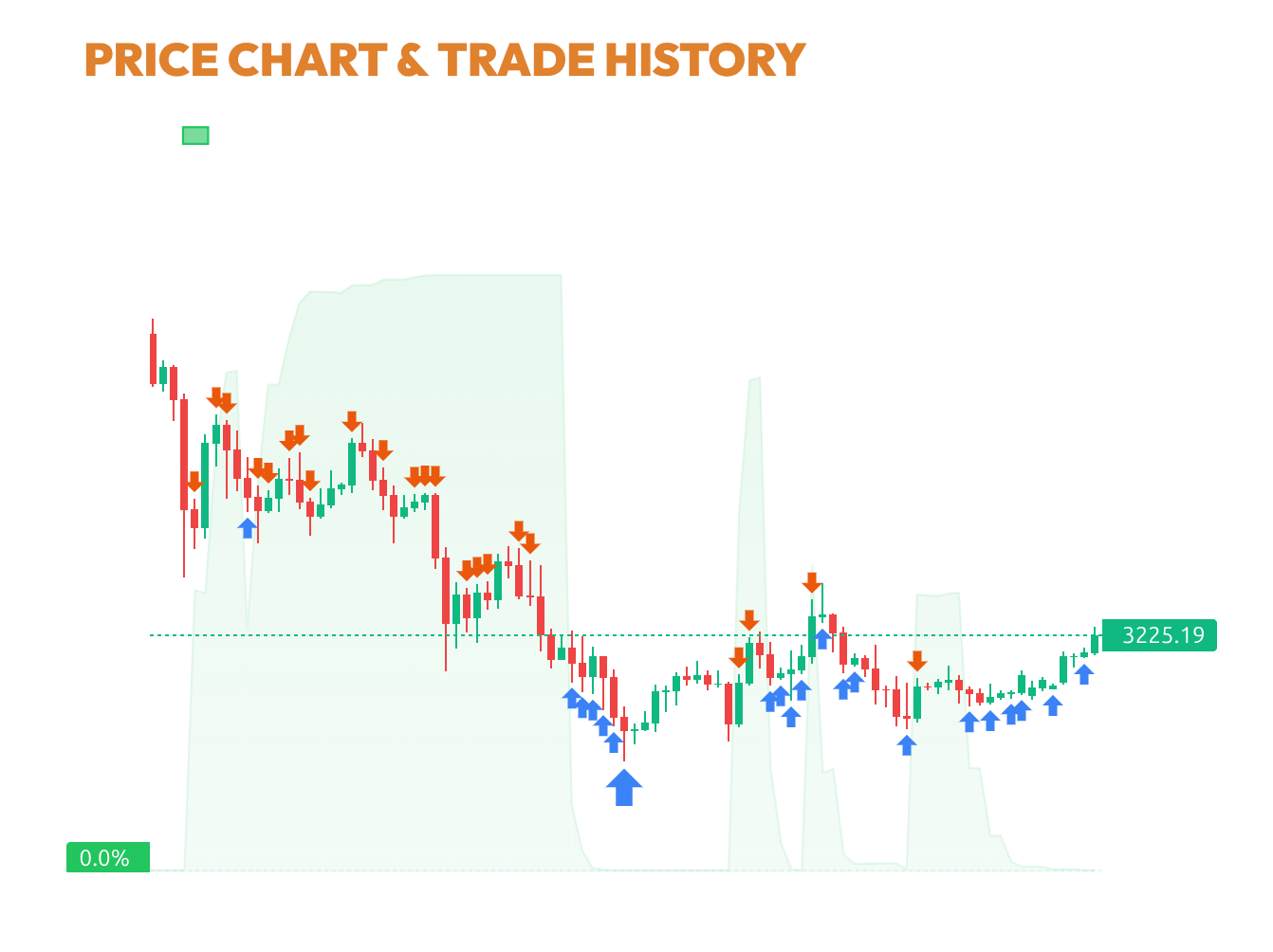

The primary decision signal for Ethereum is a BUY with full conviction at a current price of $3,225.19. Over the past three months, the system's behavior has shown increased buying activity, especially in late December and early January, resulting in a 100% allocation to ETH with no cash reserves remaining. This reflects the system's strong confidence in the upward price movement. Monte Carlo projections support this with a positive bias of 16.0, indicating a probability of 58% for a continued BUY, although the reliability of this projection is moderate. The decision audit confirms the structural stability of the current regime with integrity levels showing minor fluctuations. Overall, the alignment of technical signals, probabilistic bias, and audit outcomes justify the aggressive position taken, consistent with the high conviction BUY directive.

SIGNAL

POSITION

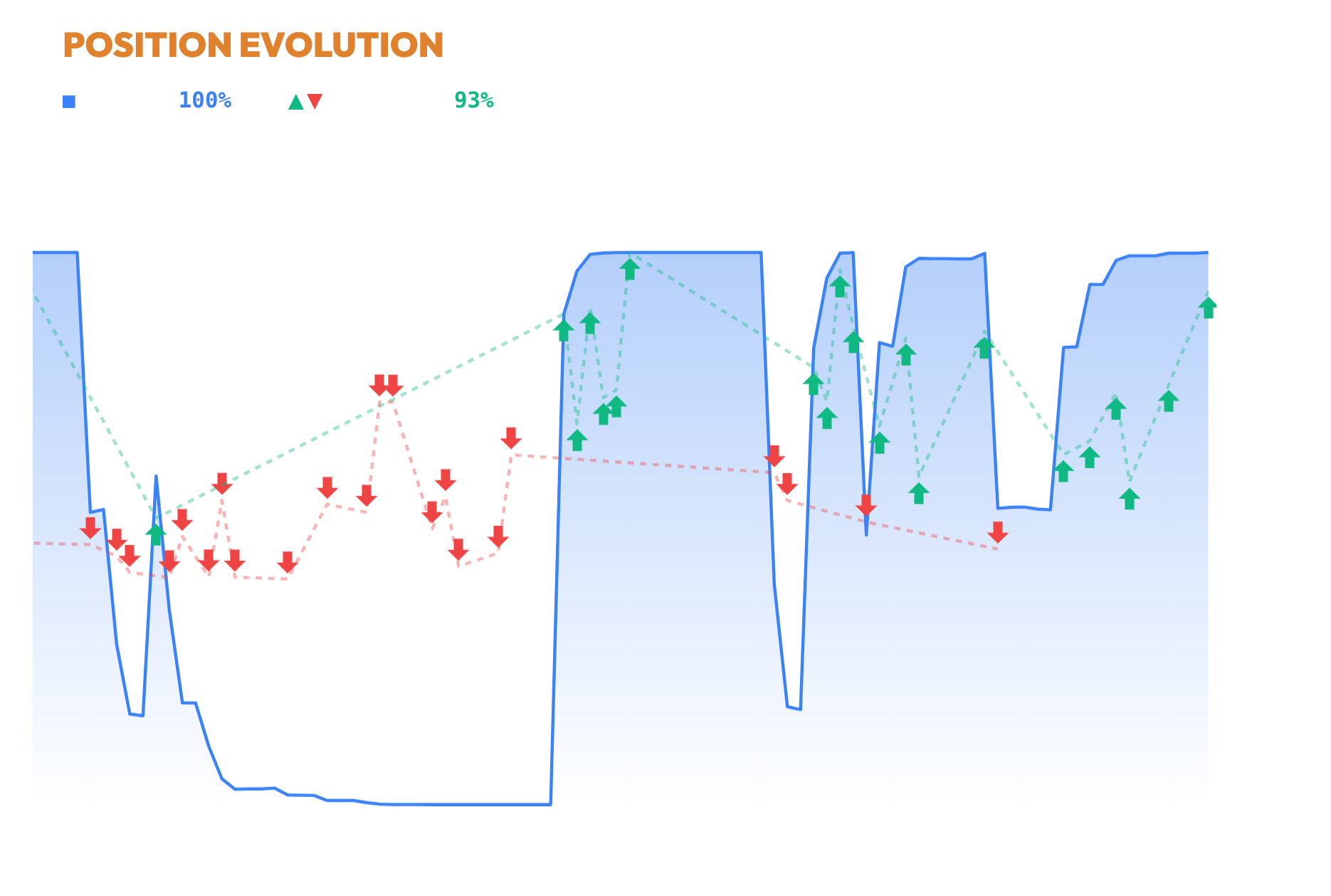

The current position size is nearly 100% with an insignificant cash percentage remaining. This state was achieved through a series of consecutive buys from December 24, 2025, to January 4, 2026, gradually increasing the position from 53.6% to 99.9%. The most recent buy on January 4, 2026, slightly increased the position by 0.1% with an exposure weight of 93.0%. Prior to this, a significant decrease occurred on December 19, 2025, when the position size was reduced from 99.8% to 53.6%.

CHART

Over the observed three-month period, the system exhibited a significant increase in buying activity, particularly in late December and early January, with six consecutive BUY decisions reflecting rising confidence levels, peaking at 0.83 on January 4, 2026. Prior to this, the system had a period of mixed decisions, including a notable SELL on December 19, 2025, with a lower confidence of 0.48. Throughout this timeframe, the position size steadily increased, reaching a full allocation of 100% by January 2026, indicating a strong conviction in the upward price movement. Cash reserves correspondingly decreased to 0%, underscoring a full commitment to the asset. Price action during this period shows a recovery trend, providing a conducive backdrop for the system's aggressive allocation strategy.

REGIME

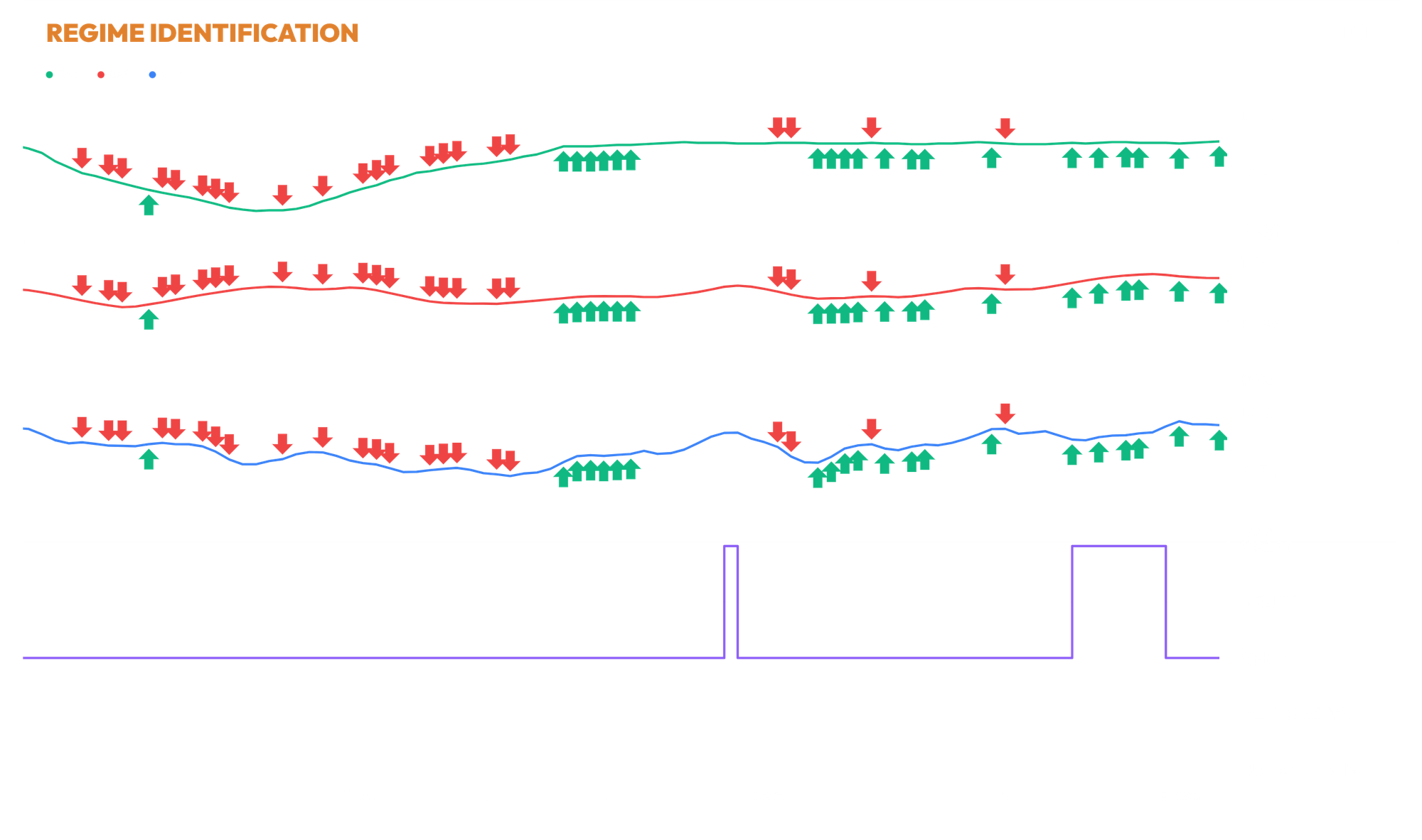

Material integrity is at 76.3%, showing a slight upward trend (+0.01), while energetic integrity remains stable at 87.6%, and ethereal integrity is slightly declining at 90.0% (-0.01). Within the current CHOP regime, these conditions indicate a structurally stable environment with minor fluctuations. The provided trade history does not allow a clear temporal linkage between execution and integrity changes, as no recent trades are recorded.

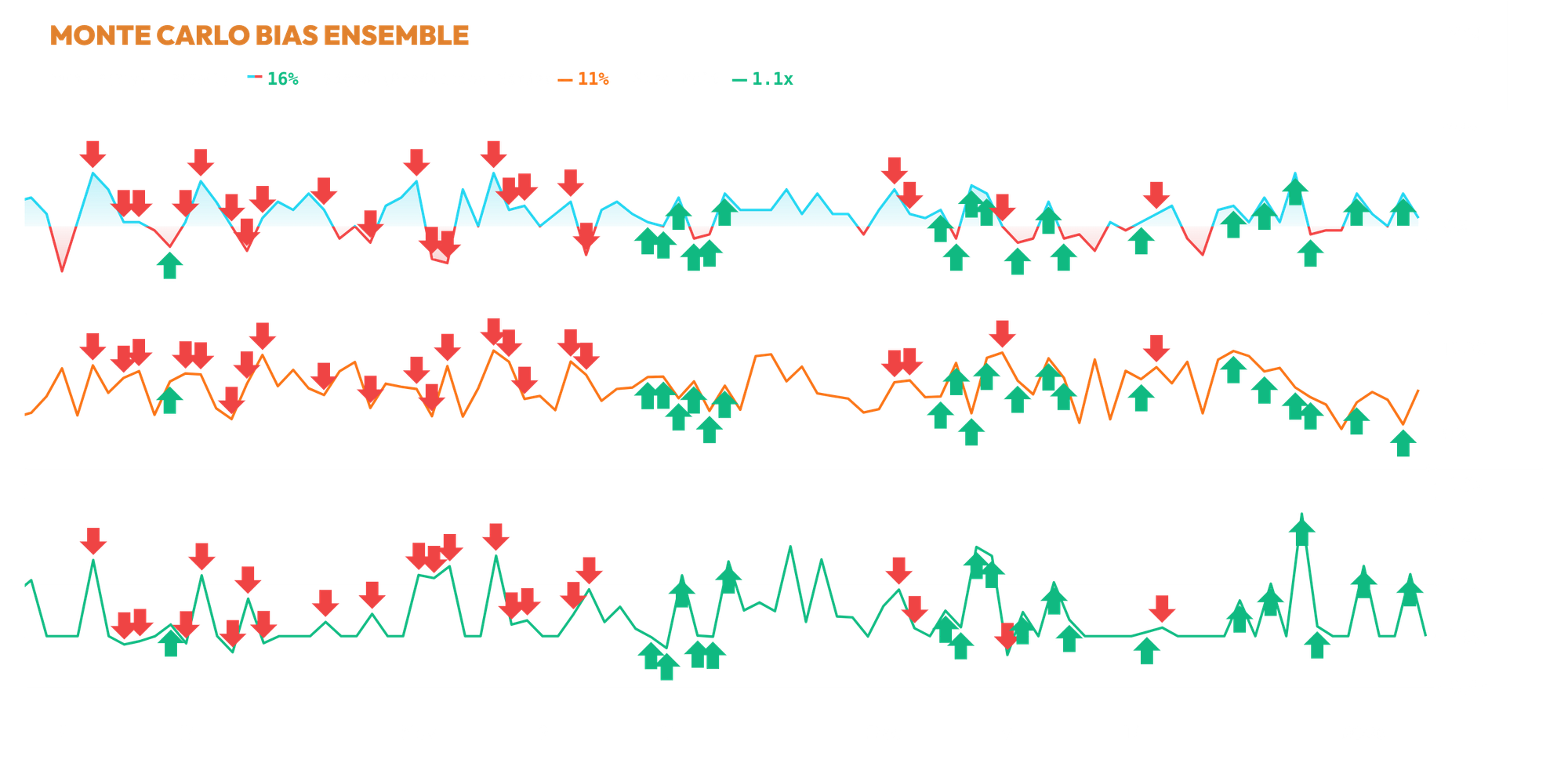

MCBIAS

The current net MC bias is 16.0, indicating a positive directional skew. The dispersion quality, as assessed by the sigma percentile rank, is 50.0%, which falls into the moderate reliability range. Recent BUY signals have coincided with increases in the net MC bias, particularly evident on 2026-01-04 and 2026-01-01, aligning with periods of directional strength. Conversely, HOLD signals were observed during periods with less pronounced bias changes. Taken together, the current Monte Carlo skew of 16.0 over the last 10 bars, with a sigma percentile rank of 50.0%, indicates moderate interpretability of the simulation bias at this time.

DECISION

📊 Ensemble Consensus: BUY

[BuyStats] z=0.18, Sharpe=1.01, Hurst=0.77, ADX=23.2, AC=0.08 (x2)

[BuyCalc] base=0.521, integ=0.90→1.15, vov=0.00→1.15 → conf=0.690 (x2)

[FILTER] int_min=0.452, vov_max=0.070, int=0.900, VoV=0.005 (x2)

[decision] 🔎 PI=0.76, trend=+0.000, zone=strong; 🟢 PI strong → buy conviction boosted; 📏 Conviction margin=0.015 (regime_integrity=0.90, integ_trend=-0.000, trend_dir=+1); 🟢 Stable regime (0.90); ⚖️ Conviction Δ=0.384 → dominance=1.00; ✅ Confirmed BUY (MC=0.54) (x1)

✅ Action: BUY (conf=0.83) (x1)

🧗 Tier Snap: 1.19 (conf=0.83 >= 0.65) | 🛡️ Structural Adj: 0.78x

transparency note: this report is generated by individual decision engines (price, regime, momentum, probability) and synthesized by a consensus logic layer. the 'verdict' is the raw output of that consensus. full methodology and live trace available in the execution logs.

Member discussion