SOL Decision Analysis - January 5, 2026

Oracle Commentary

The primary decision for SOL is a strong BUY with a conviction of 100%, supported by an allocation shift to a nearly full position at 99.6%. This decision follows a consistent buying pattern observed from October 2025 to January 2026, with confidence notably peaking on January 5th. Despite a brief selling phase in late December, the overall strategy reflects a bullish stance as the price recovers from earlier declines. Monte Carlo projections reinforce this decision with a 6% positive directional skew, though with moderate reliability, indicating a consistent increase in buying probability. The decision audit highlights stable material integrity and high energetic integrity within a calm trend regime, underscoring low volatility and trend persistence. The current position size aligns with the system's high conviction, ensuring a robust portfolio stance.

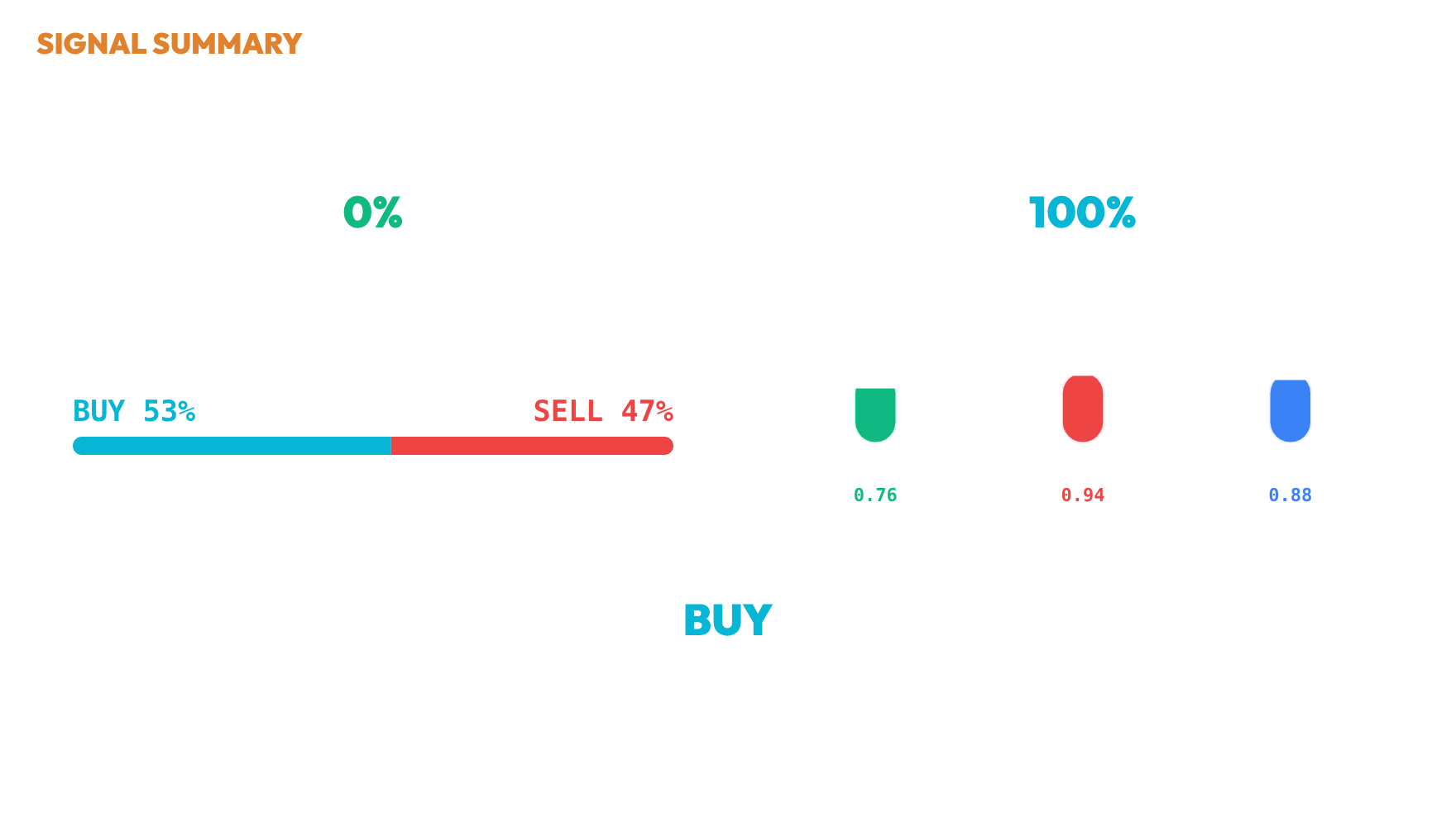

SIGNAL

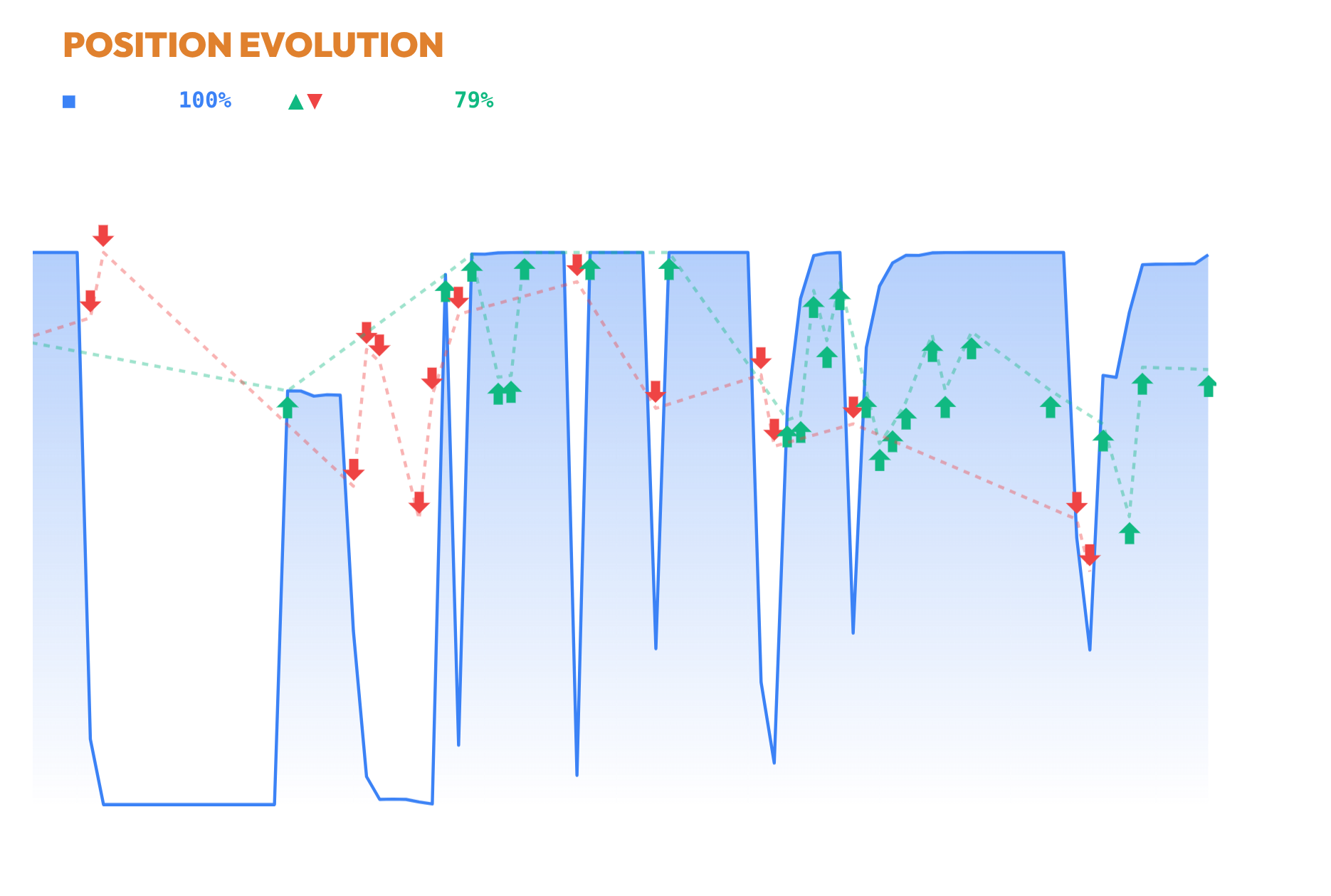

POSITION

The current position size is 99.6%, with a cash percentage of 0.42%, following a recent buy action on January 5, 2026, which increased the position size by 1.8% from 97.8%. This action had an exposure weight of 78.8%. Previously, several buy actions in December 2025 steadily increased the position size, with significant purchases on December 28 and 30, showing Convictions of 68.9% and 52.2%, respectively. The position had decreased substantially on December 26 and 27 due to sell actions, before the subsequent buying trend resumed.

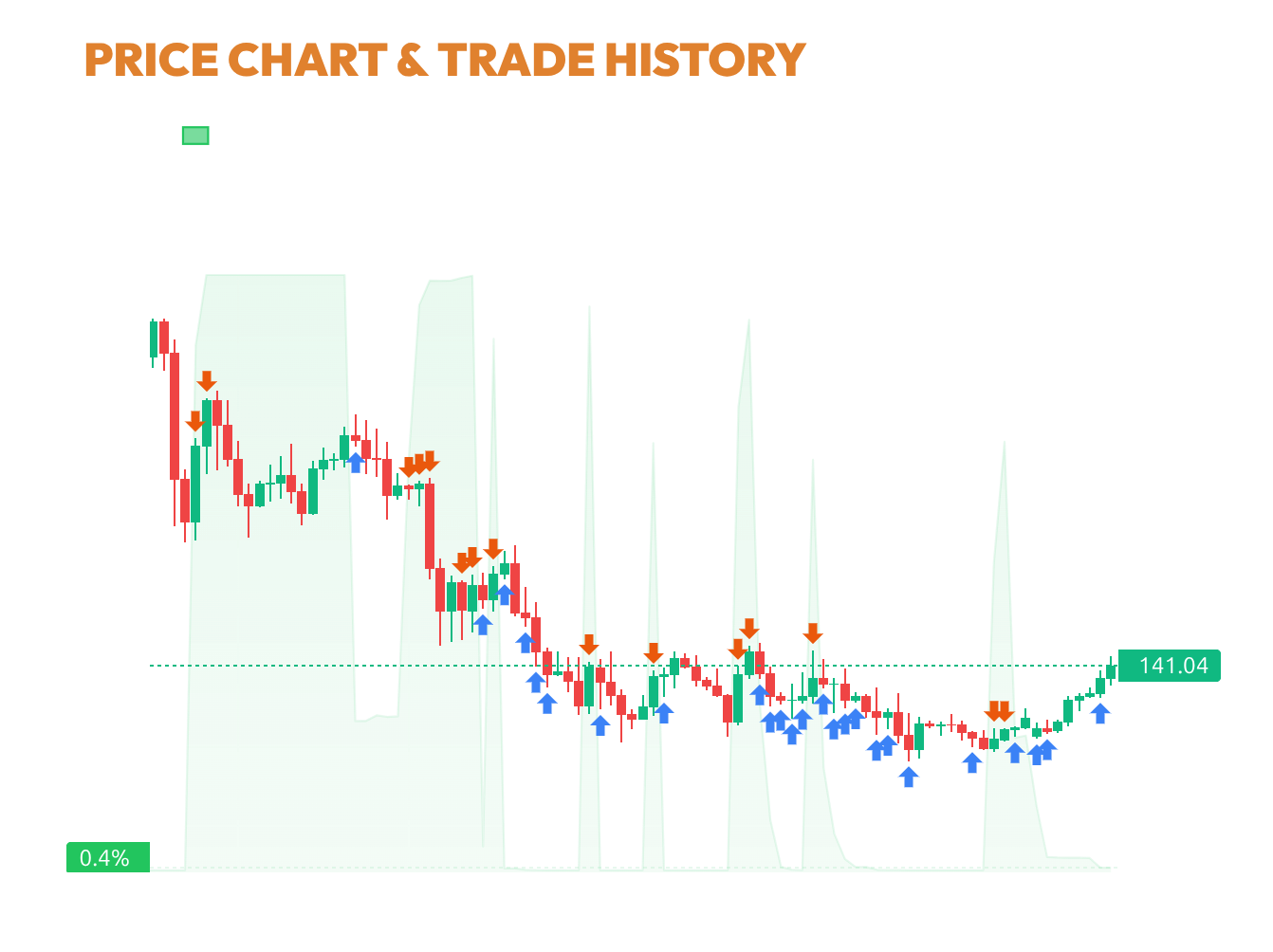

CHART

Throughout the observed period from October 2025 to January 2026, decision activity for SOL has been characterized by frequent buying, particularly in late December and early January, with a notable increase in confidence levels. The system demonstrated a consistent buying pattern, with confidence peaking at 0.70 on January 5th, leading to a significant allocation shift towards a nearly full position, currently at 99.6% invested. This is contrasted by a brief selling phase in late December, which saw confidence dip to 0.46, prompting minor cash retention. The price action during this period shows a gradual recovery from earlier declines, providing a backdrop to the system's increased bullish stance. Overall, the allocation strategy reflects growing confidence in upward price momentum, as evidenced by the latest allocation decisions.

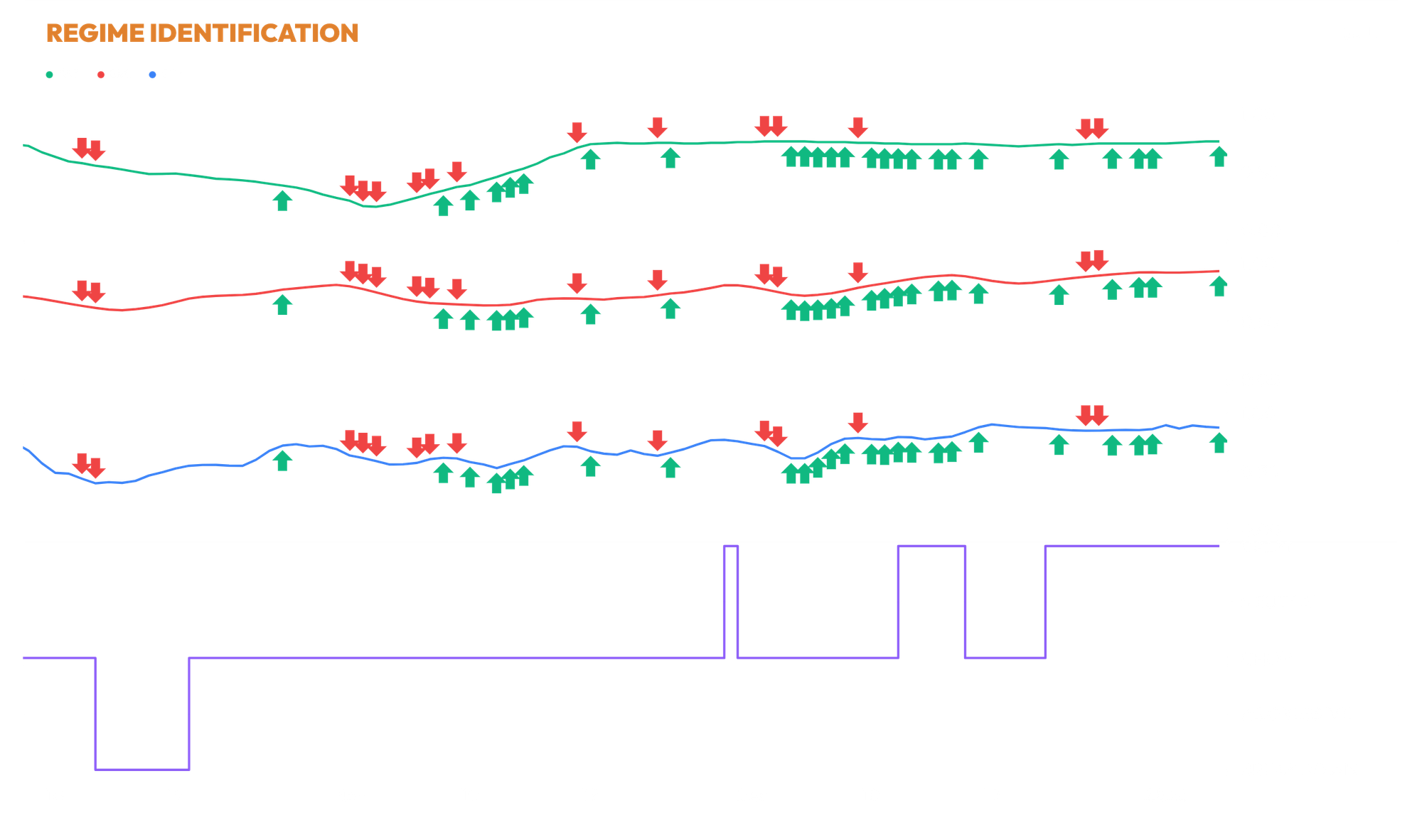

REGIME

Material Integrity is stable at 76.3% with no recent trend change, while Energetic Integrity is high at 93.6%, showing a slight increasing trend of +0.01. Ethereal Integrity is at 87.8%, with a minor decline trend of -0.01. The current regime mode is CALM_TREND, characterized by low volatility and trend persistence. The provided trade history does not allow a clear temporal linkage between execution and integrity changes, as no recent trades are recorded.

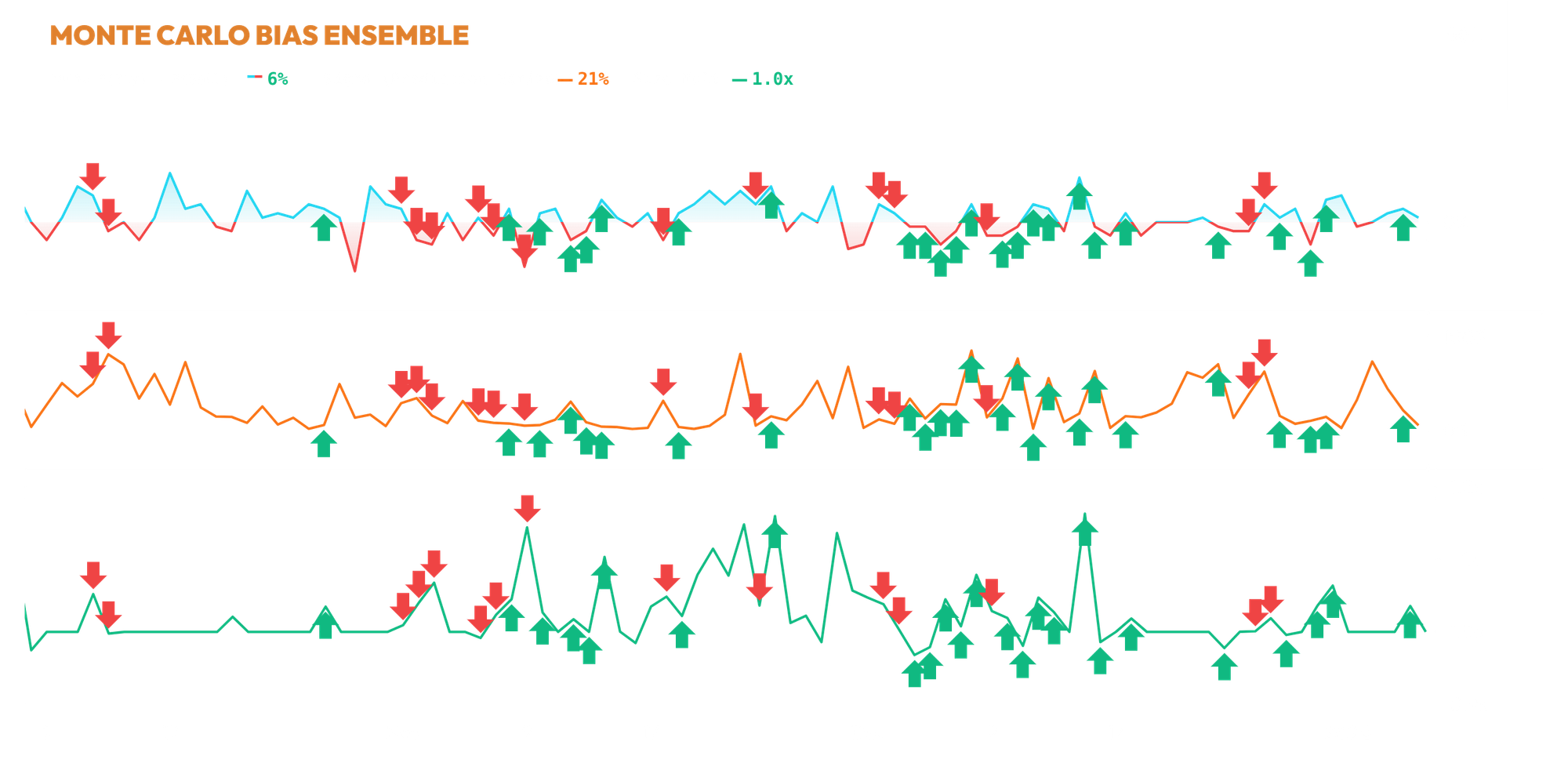

MCBIAS

The current net Monte Carlo bias is 6.0, indicating a positive directional skew. The sigma percentile rank of 50.0% suggests moderate reliability in the dispersion quality. Recent BUY markers align with an increase in the net bias from a hold signal to a strong buy signal, indicating a consistent increase in the probability of buying. Taken together, the current Monte Carlo skew of 6.0 over the last 10 bars, with a sigma percentile rank of 50.0%, indicates moderate interpretability of the simulation bias at this time.

DECISION

📊 Ensemble Consensus: BUY

[decision] ⚖️ Conflict → BUY prioritized (Δb=0.18, Δs=0.01, Δ=0.17>0.01) (x1)

[BuyStats] z=1.19, Sharpe=1.18, Hurst=0.80, ADX=21.1, AC=0.02 (x1)

[BuyCalc] base=0.408, integ=0.88→1.15, vov=0.00→1.16 → conf=0.546 (x1)

[FILTER] int_min=0.451, vov_max=0.070, int=0.878, VoV=0.003 (x1)

✅ Action: BUY (conf=0.70) (x1)

📊 Shape Adj: 0.98x (skew=-0.16, kurt=-0.53) | 🧗 Tier Snap: 0.79 (conf=0.70 >= 0.65)

transparency note: this report is generated by individual decision engines (price, regime, momentum, probability) and synthesized by a consensus logic layer. the 'verdict' is the raw output of that consensus. full methodology and live trace available in the execution logs.

Member discussion