SOL Oracle Report - 2026-01-30

Oracle Commentary

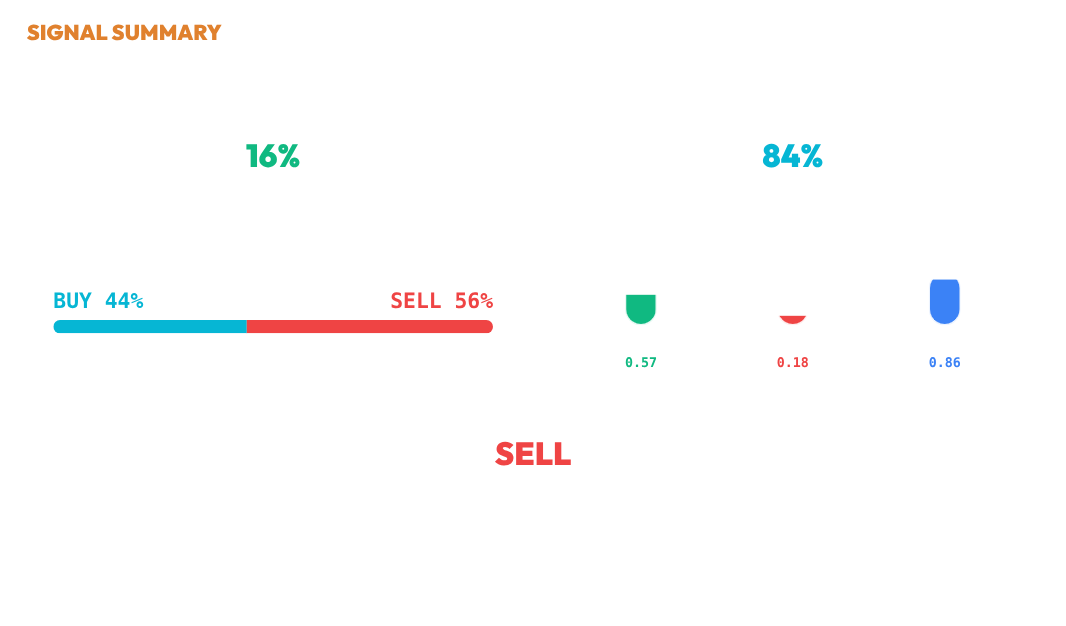

As of January 27, 2026, the system maintains a 16.4% exposure with a 83.6% cash position, following a SELL signal with an 83.6% conviction (Signal Panel, Position & Risk). Over the past three months, SOL has experienced a downward trend with notable volatility, prompting a defensive posture as reflected in the recent significant reduction from full exposure to the current level (Chart Analysis, Position & Risk). Monte Carlo simulations show a probability of selling at 56.0% against a 44.0% probability of buying, with a high ensemble entropy of 0.99 suggesting strong agreement among simulated outcomes, reinforcing the decision to reduce exposure (MC Projections). The Decision Audit confirms alignment with the SELL recommendation, despite mixed structural integrities, as evidenced by a Material Integrity of 57.2%, Energetic Integrity of 17.9%, and Ethereal Integrity of 85.8% (Decision Audit). Taken together, the system's posture reflects a cautious approach in response to a market environment characterized by elevated noise and declining momentum, aligning exposure sizing with probabilistic and structural assessments (Signal Panel, Decision Audit).

Signal Summary

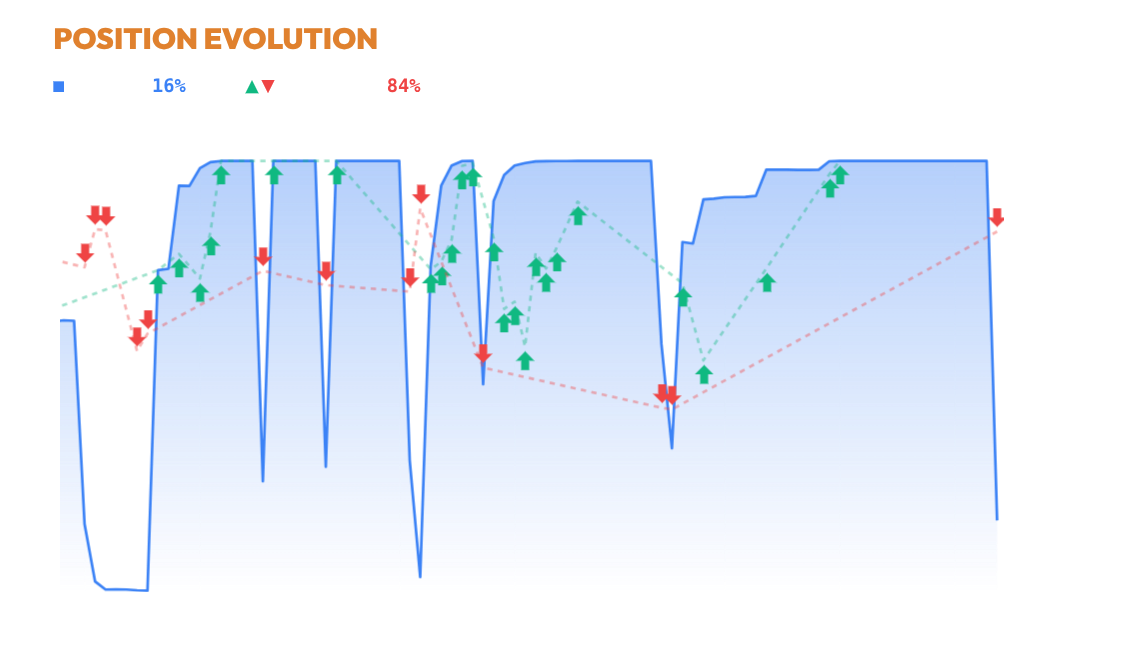

POSITION

Exposure stands at 16.4% following the January 27 sell action, which reduced allocation from 100% to 16.4%. The blue exposure line shows a sharp drop pattern reflecting this significant decrease. The system has moved to a predominantly cash position.

CHART

Over the three-month period, SOL exhibited a downward trend, characterized by notable volatility, particularly in November and December. The system responded with frequent trading decisions, initially reducing its position as confidence wavered around the end of 2025. There was a series of BUY signals in late December through early January, with confidence peaking at the start of 2026, aligning with a temporary price recovery. However, the recent SELL action on January 27, with a moderate confidence level, indicates a defensive posture as the price resumed its decline. The current allocation shows a significant cash position at 83.6%, reflecting a cautious stance amidst ongoing market uncertainty. Overall, the chart reflects a period of strategic caution as price pressures persist.

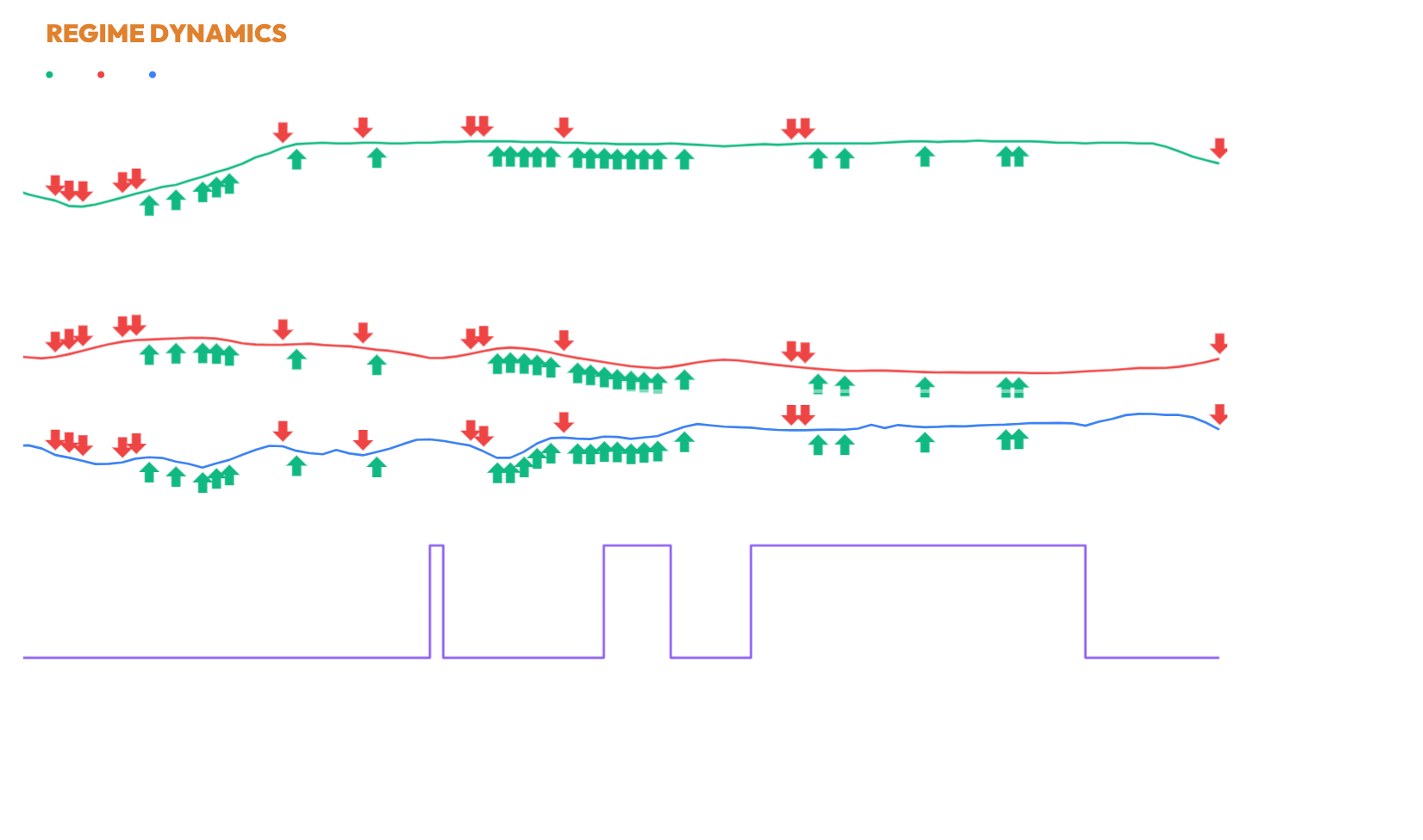

REGIME

The Material Integrity is at 57.2%, indicating moderate structural health with a slight downward trend. Energetic Integrity is weak at 17.9%, though displaying a minor upward trend, suggesting some improvement in participation stability. Ethereal Integrity remains strong at 85.8% but is experiencing a decline, indicating weakening momentum persistence. Within the CHOP regime, characterized by elevated noise and reduced directional coherence, these conditions reflect a mixed structural environment. The provided trade history does not allow a clear temporal linkage between execution and integrity changes. Overall, the market environment shows inconsistent participation with strong but declining momentum.

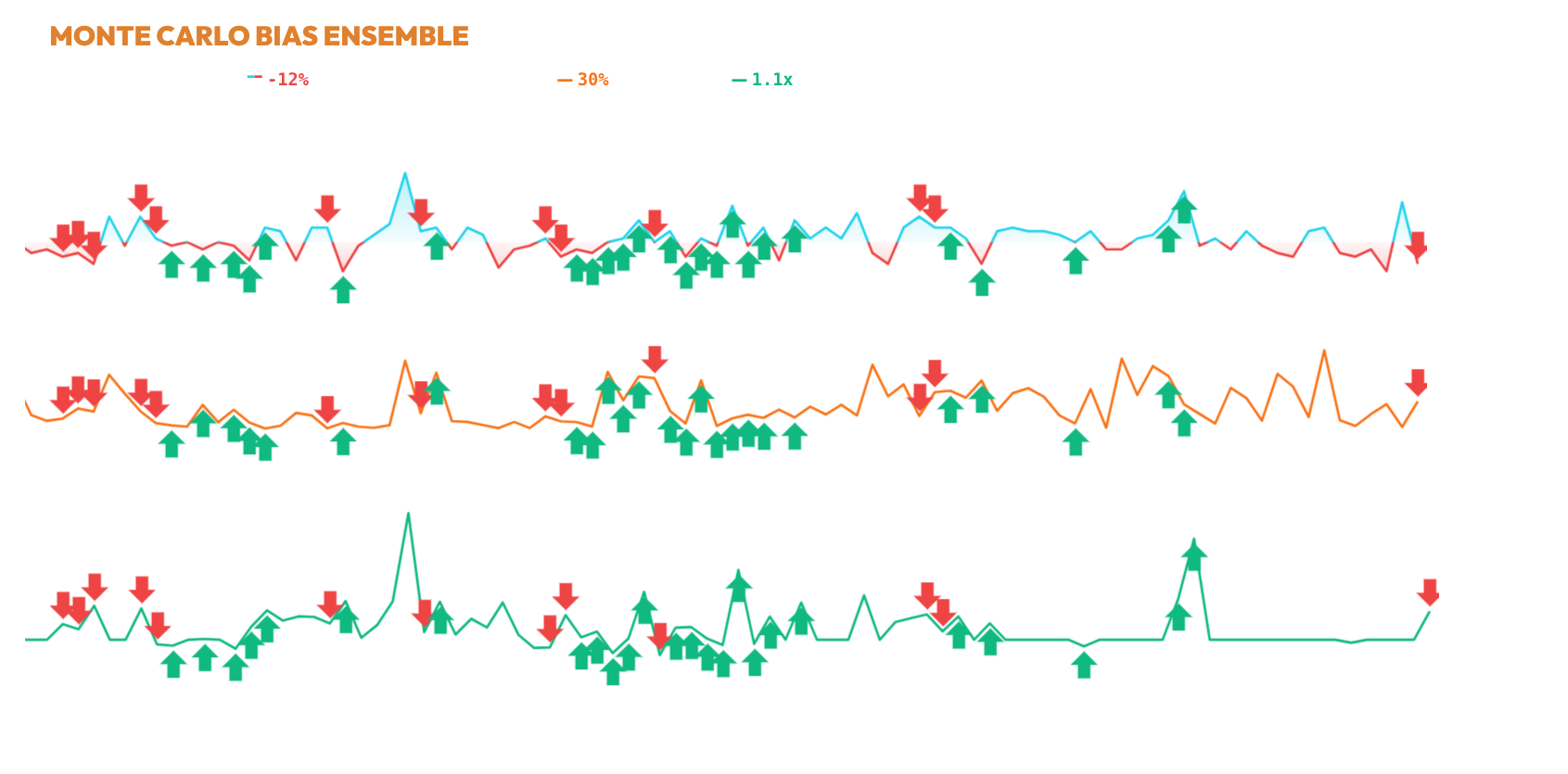

MCBIAS

The SagaHalla Stochastic Ensemble simulation as of 2026-01-27 indicates a directional drift with p_buy at 44.0% and p_sell at 56.0%, suggesting a raw probability bias towards a negative outcome. The ensemble_entropy is high at 0.99, reflecting a concentrated distribution with strong agreement among simulated paths. Risk-adjusted confidence is measured at 40.3%, resulting in a moderate MC sizing multiplier of 1.07x. Notably, the final ensemble decision to sell diverges from the pure MC bias, indicating the influence of additional system factors such as regime and integrities. Probabilistic simulations show a slight negative bias, reinforcing the decision to reduce exposure.

DECISION

📊 Ensemble Consensus: SELL

[SellStats] z=1.56, Sharpe=-0.27, Hurst=0.67, ADX=21.1, AC=0.08 (x2)

[SellCalc] base=0.368, integ=0.86→0.85, vov=0.00→0.82 → conf=0.256 (x2)

[Filter] Min Ethereal Integrity=0.452, Max Volatility Stability=0.069, Ethereal Integrity=0.858, Volatility Stability=0.003 (x2)

[Ethereal Integrity] level=0.86, trend=+0.000 → ×1.00 (x2)

Statistical sell: z=1.56, sharpe=-0.27, vol_adj=1.02 (x2)

[Scenario statistical_sell] score=1.02 → +16.0% (x2)

[decision] 📏 Conviction margin=0.015 (integrity=0.86, integ_trend=-0.004, trend_dir=+1); 🟢 Stable regime (0.86); ⚖️ Conviction Δ=-0.168 → dominance=-1.00; ✅ Confirmed SELL (MC=0.40) (x1)

✅ Action: SELL (conf=0.51) (x1)

📊 Shape Adj: 1.04x (skew=0.38, kurt=0.08) | 🧗 Tier Snap: 0.84 (conf=0.51 >= 0.5)

transparency note: this report is generated by individual decision engines (price, regime, momentum, probability) and synthesized by a consensus logic layer. the 'verdict' is the raw output of that consensus. full methodology and live trace available in the execution logs.

Member discussion