How does it Work?

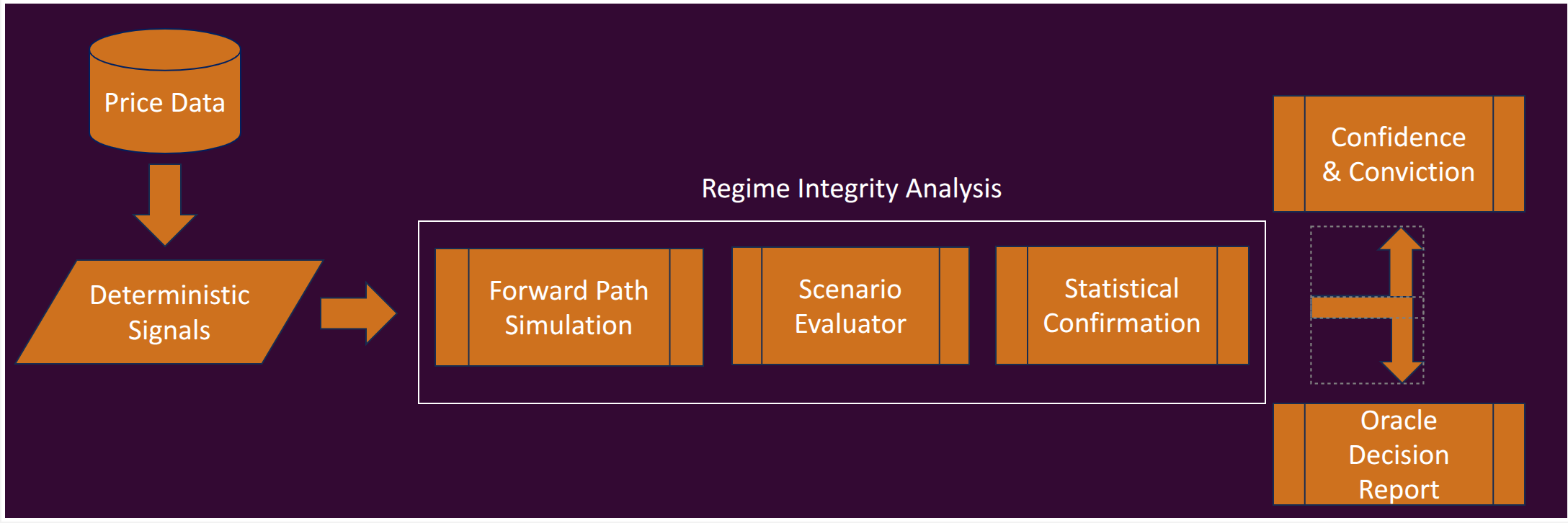

The SagaHalla Oracle is designed to reveal the “why” behind every decision. Its deterministic three-stage decision architecture — Signals → Regime Context → Simulation → Confirmation — transforms raw price behavior into transparent, risk-adjusted clarity. Every layer is explainable. Every step is traceable.

Five Pillars of Transparency

- Forward-Looking Risk — simulations expose likely paths and tail-risk extremes.

- Deterministic Statistical Signals — transparent rules, no opaque decision-making.

- Regime Integrity Checks — filters unstable, fragile, or decaying environments.

- Conviction Scaling — position size adapts to alignment, integrity, and risk.

- Proof-of-Trade Logging — every input, regime state, and confirmation is recorded.

1. Asset Signal Layer

The Oracle begins by detecting statistically significant structure in price behavior. Signals are fully deterministic and include:

- Multi-window trend and structure alignment

- Z-score deviations and return extremes

- Market structure shifts and extrema formation

- Volatility compression, expansion, and shock behavior

- Momentum vs mean-reversion autocorrelation

- Trend exhaustion and weakening detection

These signals define the directional opportunity — but they never act alone.

2. Regime Context Layer

Markets operate in regimes, not in isolation. The regime engine determines whether the current environment supports continuation, reversal, accumulation, instability, or decay.

Core Regime Integrities

- Material (Structura) Integrity — structural stability of price itself, including continuity, extrema behavior, and band coherence.

- Energetic Integrity — volatility health: expansion, compression, instability, and volatility-of-volatility stress.

- Ethereal (Temporal) Integrity — structural memory and persistence: whether trends survive, recover, or decay over time.

The regime layer defines the when — suppressing trades during fragile, chaotic, or structurally failing conditions.

Regime awareness prevents false confidence.

3. Forward-Path Simulation Layer

Where most systems stop, SagaHalla continues. Every potential trade is evaluated across thousands of Monte Carlo paths to estimate:

- Expected return distributions

- Worst-case outcomes and tail risk

- Alignment between future paths and the active regime

Simulations answer the how likely — revealing the full distribution of outcomes, not a single point forecast.

4. Transparent Confirmation Logic

A trade is executed only when all layers align:

- Signals indicate directional opportunity

- Regimes support the behavior implied by those signals

- Simulations show favorable asymmetry and bounded risk

Conviction determines how much to act. Confidence reflects how well-supported that action is.

Why This Approach Works

- Reduces false positives through multi-layer agreement

- Controls downside risk by avoiding decaying or unstable regimes

- Adapts exposure using integrity-aware conviction scaling

- Maintains explainability with complete decision traceability

into a single transparent decision engine.

Engineered for Explainable Evolution

SagaHalla is deliberately hand-tuned today to preserve full explainability. Future versions may incorporate machine learning for optimization only — such as adaptive thresholds or scenario weighting — but never in ways that obscure the decision path.

Explainability is a design constraint, not a feature.